- INTRODUCTION

Electrical energy is one of the main inputs for the Brazilian industry, and the safety of its supply and its cost are determining and essential factors for the competitiveness of Brazilian products.

According to estimates, factories account for approximately 35% of the country’s electrical energy consumption.

I.I. THE BRAZILIAN ELECTRICAL INDUSTRY

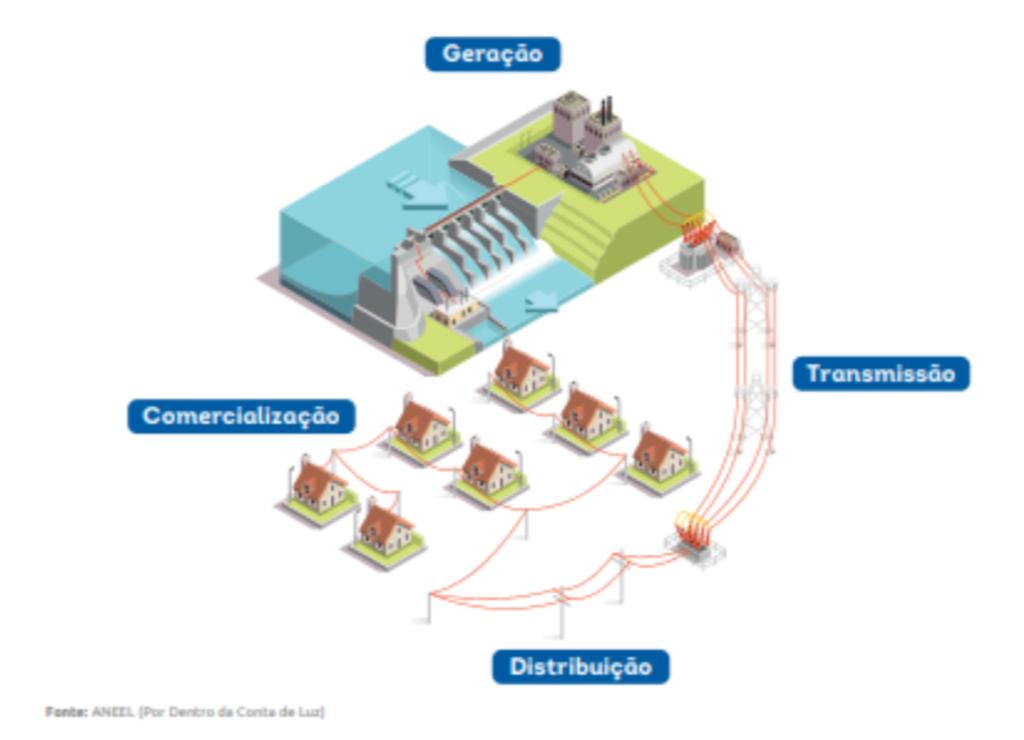

In Brazil, the electrical industry is divided into: generation, transmission, distribution, and trading*.

- Generation: is the segment of the electricity industry responsible for producing electrical energy and feeding it into the transportation systems (transmission and distribution) for it to reach consumers.

- Transmission: is the segment that transports large amounts of energy from the generating plants. Transmission is responsible for delivering energy to the distributors.

- Distribution: receives the energy from the transmission system and distributes it at retail to consumers.

- Trading: Trading companies purchase energy by means of bilateral contracts in the free environment, and they may resell this energy to free or special consumers or to other traders. They may also resell to distributors, in this case only in auctions conducted in the regulated environment.

Legend (clockwise):

Generation

Transmission

Distribution

Trading

Source: ANEEL (Por Dentro da Conta de Luz)

The Industry is also composed of the National Interconnected System (SIN), which is a large chain, extending over a large part of the Brazilian territory, congregating generation systems and an electrical transmission network, which is divided into 4 subsystems: Northeast, Southeast/Central West, South, and North.

Legend (clockwise):

Northeast

South

Southeast/Central West

The Amazon Region

North

Source: ANEEL

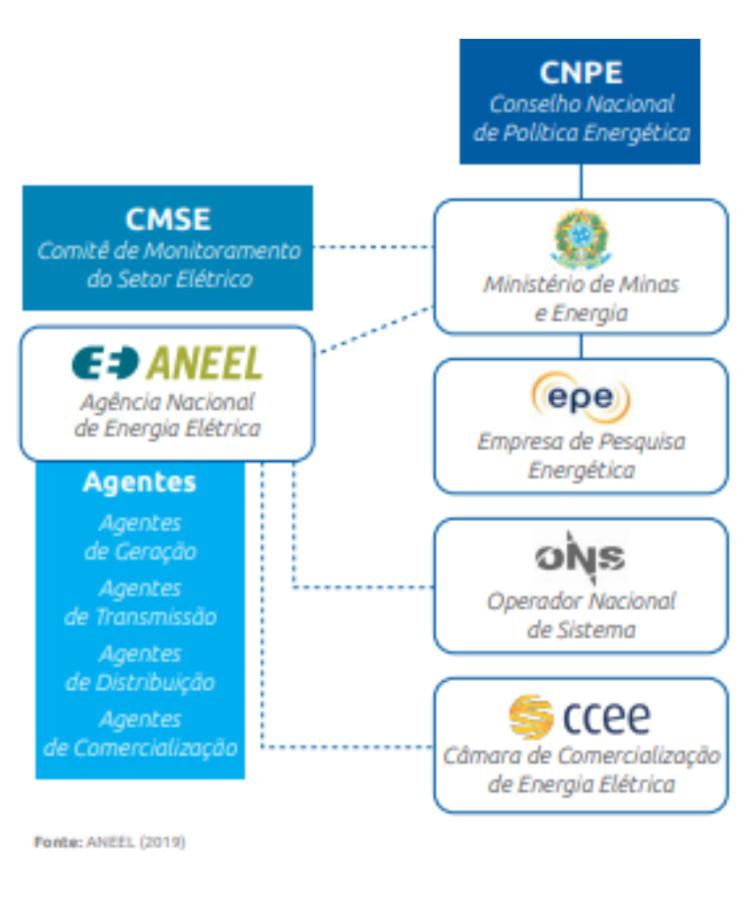

Finally, the organization chart below presents the institutions and organization of the Brazilian electrical industry, which are responsible for the governance and organization of such industry:

Legend:

Column 1

CMSE – Electrical Industry Monitoring Committee

ANEEL – Brazilian Electrical Energy Agency

Agents

Generation Agents

Transmission Agents

Distribution Agents

Trading Agents

Column 2

Ministry of Mines and Energy

EPE – Empresa de Pesquisa Energética [Energy Research Company]

ONS – National System Operator

CCEE – Electric Energy Trading Chamber

Source: ANEEL (2019)

I.I.1 Contracting Environments – Energy Markets

The Electrical Industry is divided into two energy contracting environments, to wit: (i) captive market and (ii) free market.

- Captive Market or Regulated Contracting Environment – ACR: in the captive market, consumers may only purchase energy from local distributions that hold a concession to sell energy in that region. The captive market is estimated to account for 64.6% of the total consumption of energy in Brazil.

- Free Market or Free Contracting Environment – ACL: in the free market, consumers purchase energy directly from the generators or traders, through bilateral contracts with freely negotiated conditions, such as price, term, and volume. The free market is estimated to account for 35.4% of the total consumption of energy in Brazil and for 85.5% of industrial consumption.

I.I.2. Functioning of the Energy Market – Summary Scenario

The energy market is complex and there are a number of agents that act in the various phases of the electricity circulation chain, from generation to consumption, as shown above.

The most common agents are generators, transmitters, distributors, traders, and consumers. There are two energy contracting environments, the regulated and the free market.

Generators may operate in both environments, and they are responsible for producing electrical energy.

The transmitters transport electrical energy in high voltage to the consumer centers, but do not sell energy. Thus, they do not operate in either market.

Distributors operate only in the regulated/captive market, they lower the voltage and supply electrical energy to consumers. They sell and physically deliver energy to captive consumers and only physically deliver the energy to free consumers.

Traders operate in the free contracting environment (free market) and may engage in a variety of activities: customer representation, management, intermediation, and purchase and sale of energy.

Consumers are the purchasers of electrical energy, and they may be divided into captive and free consumers. Captive consumers only purchase energy from the distributors, through the electrical grid to which they are connected. Free consumers may purchase energy from the generators or traders, to which they pay for the price of energy, but continue to pay the distributors for use of the electrical grid.

I.I.3. Composition of the electrical energy tariff

The electrical energy tariff shall guarantee the supply of energy with quality and ensure the service providers sufficient revenue to cover efficient operational costs and remunerate investments required to expand capacity and guarantee the supply to individuals and legal entities.

The electrical energy tariff is composed of the amounts of investment and technical operations carried out during the generation, transmission, distribution, and trading processes, in addition to the sectorial charges and taxes (ICMS, PIS/COFINS, and Public Lighting Contribution), as explained in further detail below.

A.1. Costs relating to Electrical Energy Supply

With respect to the costs involved in the supply of energy, which are assessed for composition of the tariffs, we note 3 different costs, which relate to:

- purchase of electrical energy (Purchased Energy) – the value of the generation of energy purchased by the distributors for resale to their consumers is determined in public auctions, which ensures transparency of cots, competitiveness, and best prices;

- use of the distribution system and use of the transmission system (Transport of energy to the consumer units (transmission and distribution) – The costs involved in the transmission of electrical energy are those related to the transport of energy from the generating units to the distribution systems, and they are composed of the following items:

- use of the transmission facilities classified as Basic Grid, Border Basic Grid, or Other Transmission Facilities (DIT) of shared use,

- use of the distribution facilities,

- connection to DIT of exclusive use,

- connection to the distribution grids,

- transport of the energy originating from Itaipu to the point of connection to the Basic Grid, (vi) use of the Basic Grid by the Itaipu plant, and

- use of the transmission system by the power plants connected at a voltage level of 88 kV or 138 kV.

The costs involved in the distribution activity (entirely managed by the distributors), in turn, are costs related to the investments they made, in addition to the share of depreciation of their assets and the regulatory remuneration

A.2. Sectorial Charges

Despite being established by laws to enable the implementation of public policies in the Brazilian electrical sector, their amounts are set forth in resolutions or orders of the Brazilian Electrical Energy Agency (ANEEL) and are paid by the distributors through electricity bills. There are approximately 18 sectorial charges and fees that are therefore, included in the electrical energy tariff. Among these 18 charges, the Incentive Program for Alternative Sources (PROINFA) and the Energy Development Account (CDE) stand out, with the latter being the most significant in terms of relevance and value.

PROINFA aims to increase the participation of renewable sources, such as Small Hydroelectric Plants, wind energy, and biomass thermal plants, in electricity production. The funding for these projects is divided into monthly quotas, collected by distributors, transmission companies, and licensed cooperatives. The calculation of the quotas is based on the Annual PROINFA Plan (PAP) prepared by ENBPAR and submitted to ANEEL. The amounts are paid by all free and regulated consumers of the National Interconnected System (SIN), except those classified as low-income.

The CDE, in turn, is subdivided into 8 sub-items, the most important of which are the following: Fuel Consumption Account (CCC), which is a payment made to the isolated systems in consideration of the use of high-cost fossil fuels for power generation; Incentivized Sources – Distribution Tariff Discounts (Incentivized Sources), Low Income – Social and Electrical Energy Tariff (TSEE), which represents discounts from 10% to 100% in the energy tariffs of low-income residential consumers.

It is estimated that more than thirty percent (30%) of the electricity bill is due to the cost of energy.

B. Tariff Flags

The main function of the 5 Tariff Flags (green, yellow, red – levels 1 and 2 and water scarcity level) is to balance the costs of distributors with the acquisition of energy of higher value, especially from thermal plants, which occurs more frequently in times of water crisis. The flags signal to the consumer, month by month, the real cost of electricity generation that will be charged to consumers, providing them an opportunity to adjust their consumption, if desired.

C. Taxes

In addition to the tariff, the Federal, State, and Municipal Governments charge on the electricity bill PIS/COFINS, ICMS, and the Public Lighting Contribution, respectively.

Federal Taxes: The Social Integration Program (PIS) and the Social-Security Financing Contribution (COFINS) are taxes levied by the Federal Government, which are intended for the worker and for the Federal Government’s social programs.

State Tax: The Tax on the Circulation of Goods and Services (ICMS) is a state tax. As provided in article 155 of the 1988 Brazilian Federal Constitution, the tax is levied on transactions relating to the circulation of goods and services, and each State and the Federal District are empowered to define its rates. Distributors are required to charge the ICMS directly in the electricity bill and transfer the amount to the State Government. It is the tax with the greatest impact on the electricity bill.

Municipal Tax: The Public Lighting Contribution (CIP) is provided in article 149-A of the Brazilian 1988 Federal Constitution, which establishes, among the powers of the municipalities, the power to provide on the form of collection and the tax base of the CIP, by means of a specific law approved by the City Council. Therefore, the Municipal Government is solely and exclusively responsible for services involving the planning, implantation, expansion, operation, and maintenance of public lighting facilities. In this case, the concessionaire only collects the public lighting contribution for the municipality. The respective amounts are transferred even if the consumer does not pay the electricity bill.

The taxes above are the main taxes levied on electricity bills and vary according to the location, depending on the municipality and the state.

In the Section below we will describe in further detail the taxes levied on the electricity bill of the taxpayers. We note, however, that those who wish to obtain the detailed values of each of the taxes and charges with rates and impact on the amount paid in the electricity bill may check them in the electricity bills or in the tables provided by the concessionaires on their websites, as determined by ANEEL.

II. SPECIFIC TAXATION ON ELECTRICAL ENERGY

II.I FEDERAL TAXES: Social Integration Program (“PIS”) and Social Security Financing Contribution (“COFINS”)

Power supply transactions are subject to the levy of PIS and COFINS at the combined rate of 9.25% (non-cumulative regime) on the transaction price.

Legal entities subject to the non-cumulative regime may deduct credits in relation to “electrical energy and thermal energy, including in the form of steam, consumed in the establishments of the legal entity”.

Please note that electrical energy expenses entitle the legal entities to a credit irrespective of the sector or establishment of the company where the electricity is being consumed, encompassing all premises used, irrespective of their purpose (operational area, accounting, management, etc.). We further note that in these transactions, the credit shall only be granted if the energy is paid to Legal Entities domiciled in Brazil.

There is ongoing discussion in both administrative and judicial spheres regarding the possibility of claiming credits also on contracted energy, especially if the business establishment’s contracted demand is higher than the electricity consumed. The position of the Federal Revenue Office has been to deny credits in such cases, arguing that the guaranteed power of electric energy does not fall under the literal interpretation of the legal provisions concerning “consumption”. However, there have been relatively recent decisions from the Administrative Council of Tax Appeals (CARF) that accept the possibility of credit related to “expenses with contracted demand, included in the electricity bill”, as it “is mandatory, aims at the effective operation of the establishment, and has a social character… (CARF Decision 3201-007.441, dated November 17, 2020)”. Nevertheless, in a ruling made in June 2023, CARF decided that the amounts paid for contracted demand and for the use of the distribution system are not considered consumed energy; rather, they represent the amount paid by the user to the concessionaire to keep the network (means) available for electricity consumption. In this case, the prevailing understanding was that only the energy actually consumed qualifies for crediting (CARF, Process No. 10183.904627/2016-60, Decision No. 9303-014.076 – CSRF / 3rd Panel).

In 2022, Law 14,385 was enacted, which establishes the refund of ICMS included in the calculation bases of PIS and COFINS. This inclusion was deemed unconstitutional in 2017 by the Federal Supreme Court, which ordered the exclusion of this ICMS from those calculation bases and defined that the measure should be retroactive to March 15, 2017. Dissatisfied with this law, electric power distributors filed a Direct Action of Unconstitutionality (ADI) 7,324 challenging it. This ADI was initially scheduled for judgment in the Virtual Plenary, where the request for a declaration of unconstitutionality of Law 14,385/22 was ruled as unfounded. However, there was a request for a highlight by Justice Luiz Fux, resulting in the discussions being directed to the physical plenary.

The ADI 7324 was included in the judgment agenda for September 4, 2024. The Supreme Court’s Plenary began deliberating on the law that allows ANEEL to determine the allocation of amounts overpaid by electricity consumers regarding the collection of undue taxes. The judgment was suspended due to a request for a view by Minister Dias Toffoli. It is important to note that the Reporting Minister, Alexandre de Moraes, understood that the matter pertains to tariff law rather than tax law, which eliminates the need for a Complementary Law. In his view, just as the costs of overcollected taxes were transferred to users in the tariffs, the amounts refunded to the concessionaires should be passed on to consumers. The Ministers Luis Fux, Flavio Dino, Andre Mendonça, Christiano Zanin, and Nunes Marques supported the Reporting Minister’s vote.

Specifically with respect to this judicial discussion, ANEEL reported in September 2023 that there were R$ 62 billion in PIS/COFINS credits owed to electricity consumers in 2021. Of this total, part of the amount has been refunded; however, approximately R$ 20 billion is still expected to be released in the coming years.

II.II. Tax on the Circulation of Goods and on the Provision of Interstate and Intermunicipal Transportation and Communication Services (“ICMS”)

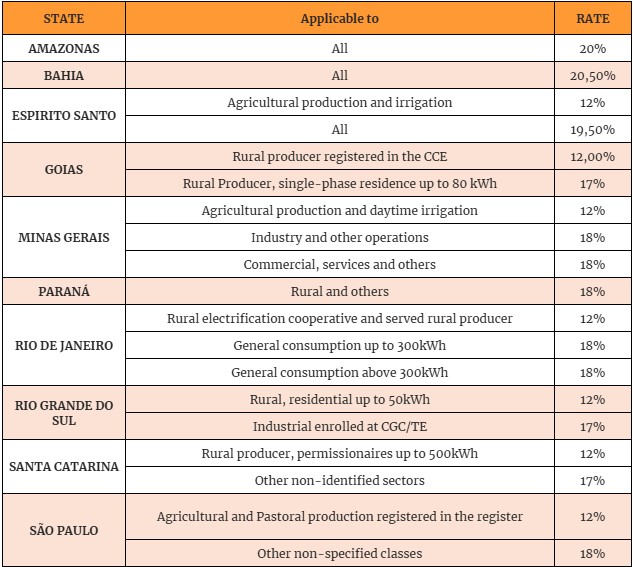

This is the tax with the greatest impact on the price of the Electricity Tariff (TE) and the one that most increases the electricity bill. Starting in 2022, the rates, which previously ranged from 18% to 32%, were reduced to values close to 18% in all states, due to the enactment of Complementary Law 194/22, which included electricity among the goods and services considered “essential and indispensable.”

II.II.1 TAX RATE

Currently, some examples of ICMS charges and their respective state rates can be found in the table below:

*This table may be subject to changes due to legislative modifications in each state.

II.II.2. TAX BASE

II.II.2.A. INTRODUCTION

In general, the ICMS tax base shall correspond to the transaction price – result of the sum of all amounts and charges inherent in the provision of electrical energy for consumption, plus the applicable ICMS amount, which have been charged, on any account, from the person indicated as recipient in the tax document as a result of the performance of an electrical energy supply agreement entered into between such person and the distribution company.

However, electrical energy concessionaires also include the transmission and distribution expenses (Transmission System Use Tariff – TUST and Distribution System Use Tariff) in the ICMS tax base, in addition to the client’s consumption, it being understood that they also add other charges passed on to third parties, which inflates the ICMS tax base, which should be levied only on the actual energy demand.

Due to this practice, our courts discuss whether or not to include the TUSD and TUST tariffs in the ICMS tax base, in which respect there were recent developments.

II.II.2.B Dispute about the Inclusion/exclusion of the Distribution System Use Tariff – TUSD and of the Transmission System Use Tariff – TUST in the ICMS tax base

TUSD (Distribution System Use Tariff) is the consideration paid to the public utility concessionaire for use of these electric systems in the generation and consumption of energy.

TUST (Transmission System Use Tariff), in turn, is the tariff that remunerates the transmission system, and which is paid by the users of the electrical power Basic Grid: generators, distributors, free consumers, and traders that import and export electrical energy. Both the Distribution System Use Tariff (“TUSD”) and the Transmission System Use Tariff (“TUST”) are charged from the consumer of electrical energy, whether in the regulated or in the free contracting environment, and they are paid in consideration of use of the system (“wire usage”). These tariffs are part of the monthly costs of the National Integrated System (SIN), which produces and transmits electric energy throughout the country.

Since 2017, there has been a judicial discussion before the Superior Court of Justice (STJ) regarding the validity of including these tariffs in the ICMS calculation base. The main argument for excluding the tariffs from the ICMS calculation base is that ICMS is a tax that should apply to the consumption of electric energy. It is argued that both transmission and distribution should be classified as the displacement of energy, thus falling outside the scope of ICMS incidence, as “making energy available” differs from “supplying” energy. Only the supply of energy would fall within the scope of ICMS incidence.

On March 27, 2017, in the records of Special Appeal 1.163.020/RS, the 1st Panel of the STJ changed the previously dominant jurisprudence that favoured taxpayers by ruling in favour of the tax authorities and against the exclusion of TUST and TUSD. The court stated that it is not possible to dissociate the stages of energy supply. It is noteworthy that until March 2017, the orientation of the public law panels of the STJ was favourable to taxpayers. The STJ suspended all processes related to this issue nationwide. The matter was considered of general repercussion, consistent with TOPIC 986/STF – Inclusion of TUST and TUSD in the ICMS calculation base applicable to electric energy. Consequently, the thesis established in the ruling will apply to similar cases pending in all courts across the country, including those that have been suspended.

Subsequently, on March 13, 2024, under the procedure of repetitive special appeals (Topic 986), the First Section of the Superior Court of Justice (STJ) unanimously established that the Tariff for the Use of the Distribution System (TUSD) and the Tariff for the Use of the Transmission System (TUST) must be included in the calculation base of the Tax on Circulation of Goods and Services (ICMS) for electric energy, in situations where they are charged on the electricity bill as a cost to be paid directly by the final consumer—whether they are free consumers (those who can choose their own energy supplier) or captive consumers (those who do not have such a choice).

Since the ruling was made under the repetitive system, the established thesis must be applied to similar cases pending in courts across the country, including actions that had remained suspended until March 2024, awaiting the definition of the qualified precedent by the STJ.

The First Section established that, until March 27, 2017 – the date of publication of the judgment by the First Panel – the effects of preliminary decisions that benefited electricity consumers are maintained, allowing them to collect ICMS without including TUSD and TUST in the calculation base, regardless of judicial deposit. Even in these cases, these taxpayers must begin to include the tariffs in the ICMS calculation base from the date of publication of the judgment on Repetitive Topic 986.

The modulation of effects does not benefit taxpayers under the following conditions: a) without filing a judicial claim; b) with a judicial claim filed, but in which there is no urgent or evident protection (or where any previously granted protection is no longer in effect due to being revoked or modified); and c) with a judicial claim filed, in which the urgent or evident protection has been conditioned on the performance of a judicial deposit.

In the case of judicial claims with final and unappealable decisions, the section considered that these cases must be analyzed individually, through the appropriate judicial channels.

It should be noted that the position adopted by the STJ above covers the period prior to the enactment of Complementary Law No. 194/2022. This Complementary Law, through its Article 2, included Article 3, item X, in Complementary Law No. 87/96, stating that starting in 2022, ICMS shall not be levied upon to TUSD and TUST, as follows:

“Art. 3 The tax shall not be levied on:

X – transmission and distribution services and sectorial charges related to electrical energy transactions. (Included by Complementary Law No. 194 of 2022)”

However, in 2022, various States filed the Direct Action for the Declaration of Unconstitutionality (ADI) No. 7195 before the Brazilian Supreme Court – STF, to challenge the constitutionality of excluding the TUST and TUSD from the ICMS tax base, due to the new wording introduced by Complementary Law 194/22 to article 3, item X of Complementary Law No. 87/96.

In the session of the virtual plenary judgment concluded on March 3, 2023, the Full Supreme Federal Court (STF) confirmed, by majority, the precautionary measure granted by Minister Fux in the mentioned Direct Action of Unconstitutionality (ADI) to maintain the suspension of the effectiveness of Article 2 of Complementary Law 194/22. At the time of granting the precautionary measure, the reporting minister noted that this LC 194/22 could have usurped legislative authority attributed to the States: there is a “possibility that the Union has exceeded its constitutional power, interfering in the way that member States exercise their tax authority”. According to Minister Fux, the reporting minister of the ADI, Article 2 of LC 194 could impact municipalities, which receive part of the tax collected by the states, which, in turn, claimed billion-dollar losses due to the removal of TUSD/TUST from the ICMS calculation base.

In light of the outlined scenario, it is likely that the STJ’s decision regarding the inclusion of TUST and TUSD in the ICMS calculation base will impact the merits judgment of ADI 7195 by the STF, which is still pending.

II.II.3 INTERNAL AND INTERSTATE ELECTRIC POWER DISTRIBUTION TRANSACTIONS IN THE STATE OF SÃO PAULO

We provide below our comments on the taxation applicable to internal and interstate electricity supply transactions.

II.II.3.A SCENARIO UNTIL 2021: JUDICIAL CHALLENGE ON TAX SUBSTITUTION OF DISTRIBUTORS

The distributors sell and physically deliver energy to captive consumers. To free consumers they only deliver energy, but do not sell it. Therefore, these free consumers purchase energy directly from the generators or traders and pay them for he energy. For that reason, in principle, the generator or traders should be defined by law as ICMS taxpayers de jure.

However, since 2009, the State of São Paulo promoted, through Decree 54.177/09, a change in the ICMS Regulations, providing that the distributors should act as substitute taxpayers and pay the ICMS due by the generators or traders, in the event of sale of energy to the free consumers.

The Decree was challenged in the STF. Direct Action for the Declaration of Unconstitutionality (ADIn) 4281 was filed, which discussed the unconstitutionality of attributing to electrical energy distribution companies, by means of a decree, liability for the payment of ICMS levied on the sales of electrical energy carried out between traders and taxpayers of the State of São Paulo. Please note that this attribution of the capacity as substitute taxpayer of energy distributors resulted in an increase in the ancillary obligations and in the cost of compliance both to the energy distributors and consumers. The ADIN was granted in late 2020 by the STF, which acknowledged especially that only a law in the narrow sense (and not a decree) could transfer tax liability to third parties. The Court modulated the effects of the decision, and it produced effects only after publication of the Appellate Decision, for which reason the law of the State of São Paulo on electrical energy distribution transactions was subject to a deep and recent amendment in 2021, upon enactment of decrees 65.823/21 (already revoked) and 66.373/21, still in force.

II.II.3.B CURRENT SCENARIO: DECREE 66.373/21- São Paulo changes the ICMS payment system in transactions with Electrical Energy in the Free Contracting Environment (ACL)

The new Decree revokes Exhibit XVIII to the ICMS Regulation of the State of São Paulo (RICMS-SP) and consolidates the rules on the matter in articles 425, 425-A to 425-H, and 426 of the RICMS-SP. Ordinance SRE 14/22 introduced the ancillary obligations relating to these provisions.

In short, it changed the payment of ICMS, which was previously made by the energy concessionaire (CPFL, EDP, ELEKTRO, ENEL, and ENERGISA) and informed by means of a Declaration (by the taxpayer) of the Purchase Price of the Electrical Energy in the Free Contracting Environment– DEVEC to the energy supplier.

The Decree basically implemented a new model of levy of ICMS on transactions with electrical energy in the Free Contracting Environment– ACL, as from April 1st, 2022, by establishing deferral of the ICMS to the time of the last transaction that results in the exit thereof to a establishment or domicile located in the São Paulo State territory to be consumed therein by the recipient in internal transactions involving electrical energy.

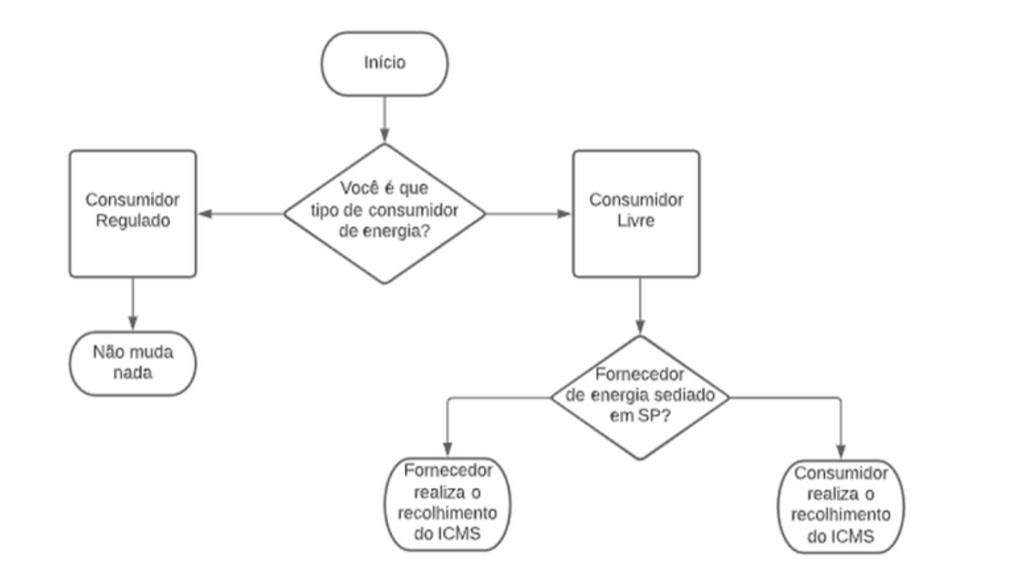

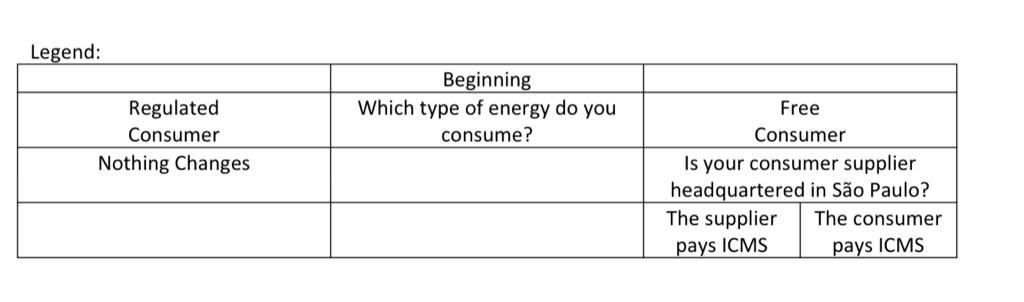

Those responsible for the assessment and payment of ICMS in interstate acquisitions are now the São Paulo state consumers and, in internal transactions, the seller.

Therefore, with respect to liability for the assessment and payment of ICMS levied on Electrical Energy, it shall be attributed (articles 425 to 425-D of the RICMS/SP):

- To the seller, located in the State of São Paulo, which carries out an electricity sale transaction to establishments located in the State of São Paulo for it to be consumed therein (internal transaction);

- To the recipient consumer located on the State of São Paulo that purchases electrical energy from a seller located in another state (interstate transaction).

With respect to liability for the assessment and payment of ICMS levied on the Connection, it shall be attributed (articles 425 to 425-D of the RICMS/SP):

- To the distributor responsible for operation of the network, in internal and interstate transactions, whenever the recipient is connected to the electrical energy distribution network;

- To the addressee, in internal and interstate transactions, whenever it is connected to the basic transmission network, relating to assessment of the tax levied on the amount of the charges involved in the connection and use of that network.

Please see:

In case the seller is located in another State, the state enrollment of consumers of the State of São Paulo also became mandatory.

There is also a provision on the simplified regime of ancillary obligations for consumers that are not originally taxpayers.

II.II.3. C Internal Electrical Energy Distribution Transactions – Tax Rates

As provided in article 52, item V of the RICMS-SP, the following tax rates apply in the State of São Paulo:

- twelve percent (12%) in relation to residential accounts with a monthly consumption of up to two hundred (200) kWh;

- twenty-five percent (25%) in relation to residential accounts with a monthly consumption above two hundred (200) kWh;

- twelve percent (12%) when used in the electrified public passenger transportation;

- twelve percent (12%) in transactions with electrical energy used in rural properties, understood as those that actually maintain agricultural or cattle raising activities and which are enrolled with the ICMS Taxpayers’ Register.

Please note that the tax rates may differ in other States. In the State of Rio de Janeiro, as provided in article 14, item VI of Law No. 2.657/1996, the tax rates applicable to transactions involving electrical energy are the following:

- eighteen percent (18%) for a consumption of up to 300 kilowatts/hour per month;

- twelve percent (12%) for a consumption of up to 450 kilowatts/hour per month for residential clients that fall under the Special Program of Differentiated Tariffs, according to the ANEEL regulation, provided compliance with the requirements and considerations set forth in a Resolution to be published by the Treasury Office;

- twenty-seven percent (27%) for a consumption above 300 kilowatts/hour per month to 450 kilowatts/hour per month;

- twenty-eight percent (28%) if above 450 kilowatts/hour per month;

six percent (6%) when used in the electrified public passenger transportation.

II.II.3.D Interstate Electrical Energy Distribution Transactions

Transactions involving the supply of electrical energy to individuals or legal entities in different States are not subject to the levy of ICMS, as provided in article 155, item X, letter “b” of the Brazilian Federal Constitution:

“Art. 155. It is incumbent upon the States and the Federal District to create taxes on:

X – it shall not be levied:

b. on transactions that send oil, including lubricants, liquid and gaseous fuels derived therefrom, and electrical energy to other States.”

However, electrical energy distribution transactions shall only be entitled to said immunity if the acquiring individual or legal entity uses electrical energy to produce goods or provide services intended for trading or manufacturing. That means that pursuant to the provisions of article 2, paragraph 1, item III of Supplementary Law No. 87/96, to benefit from immunity, the energy may not be sold to end consumers.

Please note that there are court rulings in which companies that purchased electrical energy in interstate transactions for use in the manufacturing or sale of other products were deemed end consumers of the energy, and therefore ICMS was levied on such transactions1.

1“TAX LAW. ICMS. ELECTRICAL ENERGY. INTERSTATE TRANSACTION. SALE TO END CONSUMER. The Tax on the Circulation of Goods and Provision of Services is not levied on the exit of energy from the territory of a state to be levied on the entry into the territory of another; implementation, by art. 155, item II, paragraph 2, item X, letter ‘b’ of the Federal Constitution, on the one part, and by art. 2, paragraph 1, item III of Complementary Law No. 87 of 1996, on the other part, of the tax policy of attributing to the State of destination the collection of tax when it comes to electrical energy. If the electrical energy is part of a subsequent industrialization or sale cycle without being consumed, the tax is not levied; it shall be levied if the energy is consumed in the manufacturing or sale process of other products. Precedent of the Federal Supreme Court. (RE No. 198.088, SP, Justice Rapporteur Ilmar Galvão). Appeal to the Superior Court of Justice entertained, but denied.” (STJ, Justice ARI PARGENDLER, REsp 1340323 / RS, electronic Journal of Courts of March 31, 2014).

However, in the trial of RE No. 748.543, under the general repercussion system, theme No. 689, the Federal Supreme Court decided that in interstate transactions of supply of electrical energy, only the State of destination is empowered to collect ICMS from end consumers that use the electrical energy in the manufacturing process of products relating to their core activity, as follows:

“SUMMARY. CONSTITUTIONAL AND TAX LAW. ICMS. INTERSTATE TRANSACTION OF SUPPLY OF ELECTRICAL ENERGY TO END CONSUMER, FOR USE IN INDUSTRIALIZATION PROCESS. TAX DUE TO THE STATE OF DESTINATION. APPEAL TO THE FEDERAL SUPREME COURT GRANTED.

1.(…)

2. Only the States of destination (State in which the purchaser is located) may levy ICMS on interstate electrical energy transactions, pursuant to the provisions of article 155, paragraph 2, X, ‘b’ of the Federal Constitution. Precedents: RE 198088, Rapporteur: Justice ILMAR GALVÃO, Full Bench, Journal of Courts (DJ) 09/05/2003.

3. Appeal to the Federal Supreme Court brought by the State of Rio Grande do Sul granted to deny the claim made in the complaint. Theme 689 established the following thesis of general repercussion: “Pursuant to article 155, paragraph 2, X, b of CF/1988, the State of destination is entitled to the entirety of the ICMS levied on interstate electrical energy supply transactions to end consumers, for use in manufacturing processes, and the State of origin cannot levy such tax”.”(APPEAL TO THE FEDERAL SUPREME COURT No. 748.543 RIO GRANDE DO SUL, RAPPORTEUR: JUSTICE MARCO AURÉLIO, TRIAL DATE: 08/05/2020)

Such appeal became final and unappealable on November 7, 2020, and all proceedings involving this matter in the Brazilian territory shall be tried in accordance with the decision of the Supreme Court.

With respect to the tax rates, we provide below, for illustration purposes, the tax rates applicable in the States of São Paulo and Rio de Janeiro:

II.II.3.E. Tax Rates

As provided in article 52, item II and III of the RICMS/SP, the following tax rates apply in the State of São Paulo:

- In interstate transactions destined to the States of the North, Northeast, and Center-West regions and to the State of Espírito Santo: seven percent (7%) and

- In interstate transactions destined to the States in the South and Southeast regions: twelve percent (12%)

There may be a variation in the other States, according to their locations in the Brazilian Regions.

Pursuant to article 14, item III of Law No. 2.657/1996, the following tax rates shall apply to interstate transactions in the State of Rio de Janeiro:

- whenever the recipient, whether or not a taxpayer, is located in the North, Northeast, Center-West regions and in the State of Espírito Santo: seven percent (7%);

- whenever the recipient, whether or not a taxpayer, is located in the other regions: twelve percent (12%).

II.II.4. Simplified Tax Regime in the State of São Paulo

The Simplified Tax Regime for the assessment and payment of tax by recipients, when the taxpayer status arises exclusively from operations with electric energy, is provided for in Ordinance SRE No. 14/2022.

The Simplified Regime essentially consists of the issuance of an NF-E (Electronic Invoice) and the collection of ICMS, exempting the taxpayer from submitting and delivering the ICMS Information and Calculation Guide – GIA/SP and the Digital Tax Bookkeeping – EFD ICMS-IPI. However, throughout the period during which the recipient is subject to said regime, the use of any credits of such tax shall be prohibited.

II.II.5. EXEMPTION AND TAX BENEFITS

II.II.5.1. Exemption to Rural Producers

There is exemption of ICMS, as provided in Confaz Convention 76/91, on the supply of electrical energy to rural establishments, upon satisfaction of the conditions (engage in agricultural or cattle-raising activities, be enrolled with the ICMS Taxpayers’ Register)

II.II.5.2. Benefits for GD – Distributed Generation – Modalities

There is currently an exemption granted by the States and by the Federal District, as a result of ICMS Convention 16/2015, for transactions involving distributed generation. The legal system in effect permits the granting of tax exemptions until December 31, 2032, with annual reduction of the benefit by 20% as from January 1st, 2029.

In 2023, the State of São Paulo extended the exemption of ICMS in internal transactions with electrical energy carried out by micro- and mini-generators to other modalities of distributed generation and solar photovoltaic power generating plants with installed power of up to 5MW (Decree 67.521/2023/ art. 166, Exhibit I to RICMS-SP)

II.III. MUNICIPAL TAX: PUBLIC LIGHTING SERVICE CONTRIBUTION

This municipal contribution is levied on electrical energy and is named CIP or COSIP, and its purpose is to pay for the municipalities’ public lighting services, improving the lighting of all public roads, squares, viaducts, roads, and tunnels, making them safer.

The CIP varies in accordance with the tax rates established by each municipality. As a general rule, the tax rates are related to the electricity load made available by the concessionaire and the type of consumer.

Authors: Sabine Ingrid Schuttoff / Claudia Derenusson Riedel / Camila Santana

De Luca, Derenusson, Schuttoff & Advogados – DDSA

Rua James Joule, 92 – 6th floor – Brooklin

04576-080 – São Paulo – SP

Phone: +55 (11) 3040 4040