2.a. Introduction

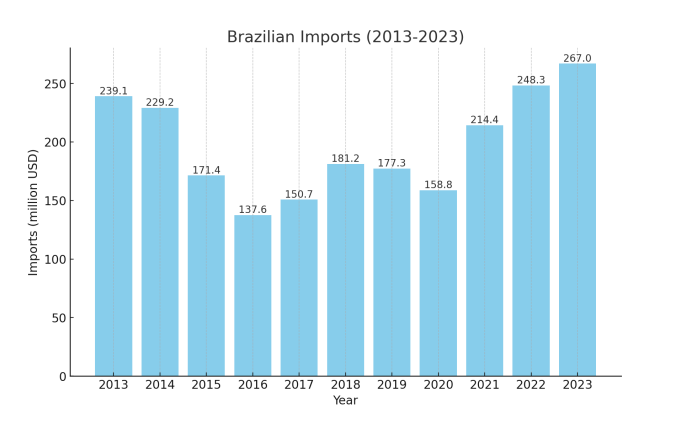

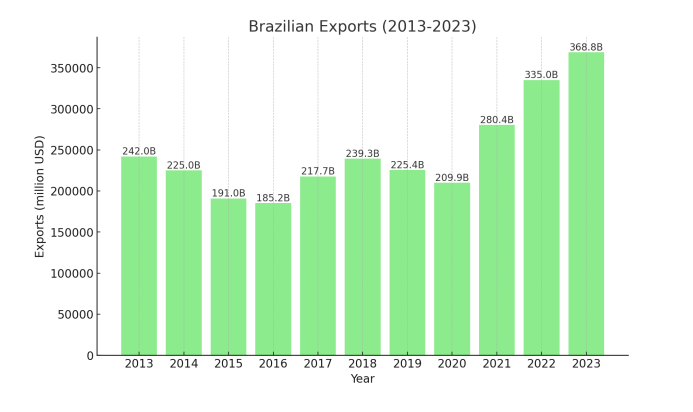

Although Brazil is among the 10 largest economies in the world, it still holds a modest share in global trade, typically around 1%. In 2022, Brazil accounted for approximately 1.02% of global imports and 1.26% of global exports. In recent years, the country has adopted more flexible international trade policies, which are beginning to improve this situation. However, the Brazilian economy continues to face challenges that impact foreign trade, particularly evident in the decline of exports and imports between 2014 and 2016, with more significant recoveries starting in 2019.

Brazilian exports account for about 14% of the country’s GDP. Several factors contribute to this percentage, including a complex tax system, logistical infrastructure, strict customs controls, a large domestic market, and cultural aspects. Additionally, the low level of internationalization among companies is a significant factor; out of the 20.6 million companies registered in Brazil in 2023, approximately 28,500 companies engaged in exporting, representing about 1% of the total number of companies in the country. As for imports, the number of importing companies is approximately 50,000.

2.b. Import Statistics

2.c. Export Statistics

2.2. Bureaucracy

2.2.a. Introduction

Foreign trade operations in Brazil are renowned for their bureaucratic complexity. The process involves extensive paperwork, multiple controls, and specific rules that must be strictly followed. Non-compliance with these regulations can lead to significant issues, such as fines and prolonged customs delays for importers and exporters. To navigate these challenges, many companies rely on specialized foreign trade consulting firms that assist in correctly adhering to regulations, thereby reducing taxes and minimizing operational delays.

Regarding customs and formalities, export procedures are generally less bureaucratic than import procedures. All activities are registered and monitored through SISCOMEX, the Integrated Foreign Trade System. Brazilian authorities use SISCOMEX to oversee international trade activities by verifying records. Numerous stakeholders are involved in international trade procedures, including the importer/exporter or trading company, customs brokers, freight forwarders, inspectors, regulatory agencies, and the Central Bank.

Bureaucratic Procedures

Licenses and Authorizations: Depending on the nature of the goods being imported or exported, various licenses and authorizations may be required from regulatory agencies, such as ANVISA (National Health Surveillance Agency) for pharmaceutical products, or MAPA (Ministry of Agriculture, Livestock, and Supply) for agricultural products.

Customs Declarations: Both imports and exports require the completion and submission of various customs declarations through SISCOMEX. These declarations provide detailed information about the products, including tariff classification, value, origin, and destination.

Customs Clearance: The customs clearance process involves the verification and release of goods by the Federal Revenue Service. This process can be time-consuming and is subject to physical and documentary inspections. Any inconsistencies may lead to the retention of goods and the imposition of fines.

Taxation: Brazil’s complex tax system imposes various taxes on foreign trade operations, such as the Import Tax (II), Tax on Industrialized Products (IPI), PIS/PASEP-Importation, COFINS-Importation, and ICMS. Each tax has its own set of rules and rates.

Transport Documentation: In addition to customs declarations, appropriate transport documentation must be provided, including the Bill of Lading (BL), commercial invoice, packing list, and certificate of origin. These documents are crucial for customs processing and international logistics.

Inspection and Supervision: Goods may be subject to inspections by various agencies, such as the Ministry of Agriculture and ANVISA, in addition to the Federal Revenue Service. These inspections ensure compliance with sanitary, phytosanitary, and safety standards.

Specialized Assistance

Given the complexity of these procedures and regulations, many companies opt to hire customs brokers and consultants specializing in foreign trade. These professionals possess the necessary expertise to manage bureaucracy, ensure compliance with laws and regulations, and optimize the import and export process, leading to significant time and cost savings.

2.2.b. Players in Foreign Trade

2.2.b.i. The Importer/Exporter

For foreign trade operations, Brazilian companies must first obtain authorization from the Federal Revenue Service. Once this authorization is granted, the company receives what is known as “Radar,” which is categorized into three main levels:

1. Limited (Up to $50,000): The company can manage up to $50,000 in transactions every six months. This is the easiest category to obtain, as it requires fewer prerequisites to be presented to the Federal Revenue Service.

2. Limited (Up to $150,000): The company can import up to $150,000 every six months, based on its estimated financial capacity. This category is ideal for

companies that are beginning their foreign trade operations and do not plan to exceed these limits.

3. Unlimited: This category is for companies that wish to import more than $150,000 every six months. It requires proof of financial capacity beyond this threshold and permits operations without a specific import limit.

Requests for Radar authorization, as well as reviews to increase the estimated operational limit, must be submitted through the SISCOMEX portal via a specific administrative process. Both in the initial authorization request and in subsequent reviews, the requesting company’s economic, financial, and operational capacity must be thoroughly assessed for compatibility.

2.2.b.ii The Trading Company

The primary role of a trading company in Brazil involves facilitating import and export operations. Beyond the usual reasons for a company to export through a trading company, Brazilian regulations provide specific motivations for this practice. For example, if a company does not have “Radar” authorization (as mentioned above), it can utilize a trading company to export its goods, thereby receiving the same tax benefits as if it were exporting directly.

However, this procedure is not allowed for imports. Any company wishing to import goods, whether through a trading company or directly, must possess “Radar” authorization. The exception is when the trading company purchases products on the international market, holds them in stock, adds a price margin, and resells them in the domestic market. This process is known as “importing to resell.” Trading companies can act as intermediaries, either on behalf of the final importer or by importing on demand. In both cases, the final importer must have “Radar” authorization and will be listed on all relevant documentation, while the trading company will be designated as the consignee.

Trading companies in Brazil typically offer their services to businesses that wish to import goods but lack the experience or resources to manage the process. They can carry out imports “on behalf of third parties,” where the trading company handles the entire import process and customs clearance, or “by order,” where the trading company purchases products abroad and then resells them in the domestic market. Both modalities enable companies to leverage the expertise and resources of trading companies, simplifying their foreign trade operations.

Recent Updates on Trading Companies

In recent years, trading companies in Brazil have been adapting to the evolving landscape of international trade by embracing digital technologies to optimize their operations and provide more efficient services. Additionally, regulatory changes have influenced the role of these companies within the Brazilian market.

Engaging a trading company is highly recommended when a foreign company seeks to enter the Brazilian market, particularly when its clients are small and medium-sized enterprises.

These clients often lack the necessary experience in handling foreign trade operations and navigating the complexities of customs procedures, making the expertise of trading companies invaluable.

2.2.B.iii. The Customs Broker

The customs broker is a vital professional in the import and export process, responsible for facilitating communication between the importer/exporter and customs authorities. Their role includes entering information into SISCOMEX (Integrated Foreign Trade System) on behalf of the importer/exporter, ensuring that all necessary data and documentation are accurate and complete.

Additionally, the customs broker maintains direct contact with Brazilian legal authorities to review and validate the information contained in import/export documents, verify the goods involved in transactions, and ensure compliance with current legislation. A critical step in customs clearance is “parametrization,” a procedure that determines the verification channel to which the import will be subjected. There are four main parametrization channels:

● Green Channel: The import is automatically cleared without any physical or documentary inspection by customs authorities.

● Yellow Channel: Documentation is reviewed, but the goods are not physically inspected.

● Red Channel: Both the documentation and the goods undergo physical inspection.

● Gray Channel: Used in cases of suspected fraud, where imports are subjected to even more rigorous verification, covering all of a company’s operations until it is proven that the company complies with all customs regulations.

The selection of the verification channel is generally random but can be influenced by various factors, such as the nature of the cargo, the importer’s experience, the origin or destination of the goods, and the company’s compliance history or any reported concerns.

The role of the customs broker extends beyond merely entering data into SISCOMEX. They also provide valuable advice to the importer/exporter on the best ways to meet legal obligations, optimize costs, and mitigate operational risks. As foreign trade norms and regulations continue to evolve, the customs broker’s role becomes increasingly crucial in ensuring that import and export operations are conducted efficiently and securely.

2.2.b.iv. The Freight Forwarder

The freight forwarder is responsible for coordinating the transportation of goods from their origin to the final destination, ensuring the freight is delivered safely and on time. Their role encompasses logistics management, documentation handling, regulatory compliance, and the provision of additional services such as cargo insurance and storage. In Brazil, the primary modes of transportation include maritime, air, and road transport, with rail transport increasingly gaining prominence.

Currently, digitization and automation are transforming the logistics industry, with freight forwarders adopting technologies to enhance efficiency and sustainability, such as electric vehicles and optimized routing systems. The expansion of rail transport is also progressing, with expectations that it will play a more significant role in freight transportation in the coming years.

2.2.b.v. The Customs Authorities

The Brazilian tax system is complex and includes a variety of taxes that apply to import operations. Conversely, the national government supports export operations by imposing fewer taxes, making exporting significantly cheaper than importing.

In Brazil, there are several federal taxes, such as Import Duty (II), Tax on Industrialized Products (IPI), PIS, and COFINS, as well as state taxes like ICMS, which varies from state to state. Additionally, other mandatory fees apply to imports, including the AFRMM (Additional Freight for the Renovation of the Merchant Marine) and the fee for the Customs Brokers’ Union guide, among others.

2.2.b.iv. Regulatory Agencies and Other Government Entities

Depending on the type of goods being imported or exported, approval from regulatory agencies and other compliance certificates may be required. The main regulatory agencies are:

● National Health Surveillance Agency (ANVISA): Responsible for the sanitary control of goods and services. Items such as medications, medical equipment, cosmetics, food, tobacco products, and others require ANVISA’s approval before shipment. ANVISA sets the standards and regulations for products and services related to health.

● Ministry of Agriculture, Livestock, and Supply (MAPA): Oversees the inspection and control of the international transit of agricultural goods, preventing the entry of pests and diseases. Agricultural products, livestock, and food must receive MAPA’s approval. Additionally, wooden pallets and boxes require a fumigation certificate approved by MAPA.

● National Telecommunications Agency (ANATEL): This regulatory agency governs the telecommunications sector, established after the industry’s privatization. ANATEL supports sector development, protects consumer rights, implements national telecommunications policies, and ensures competition within the sector.

● National Electric Energy Agency (ANEEL): Regulates electric power services, safeguarding investments, preventing abusive costs, and enforcing penalties.

● Other Agencies: Depending on the products being traded, other agencies such as INMETRO (for various sectors requiring certification) and ANP (for oil and gas) may also be involved in the regulatory process.

2.3 Logistics

2.3.a. Introduction

Brazil is a vast country, spanning approximately 8.5 million square kilometers, making logistics a significant challenge. The country’s infrastructure is not equipped to efficiently cover all regions, leading to difficulties in the movement of goods and merchandise. Long distances and inadequate infrastructure, particularly in remote areas, make logistics coordination a critical aspect of business operations. This directly impacts costs, which are reflected in the final price of products and services. Effective logistics management in Brazil is essential for maintaining competitiveness and ensuring the timely and secure delivery of goods.

Main Logistics Challenges

● Deficient Road Infrastructure: Many roads are in poor condition, leading to increased costs and longer transit times.

● Lack of Multimodal Integration: Limited integration between highways, railways, ports, and airports results in inefficiencies and higher logistics costs.

● Congested Ports: Congestion and long wait times at Brazilian ports hinder operational efficiency.

● Urban Logistics Challenges: Urban congestion and circulation restrictions increase delivery costs and times in cities.

● High Logistics Costs: Poor infrastructure, bureaucracy, and high fuel and toll costs contribute to elevated logistics expenses in Brazil.

● Bureaucracy and Regulation: Extensive documentation requirements and complex regulations raise the costs and processing times for goods.

● Transportation Security: Cargo theft is a significant issue, leading to financial losses and necessitating additional security investments.

● Climatic and Geographical Challenges: Adverse weather conditions and geographical obstacles can disrupt transport routes, causing delivery delays.

2.3.b. Air Transport

2.3.b.i. Characteristics

Brazil maintains a high level of safety in the air transport sector, ranking fifth among the safest countries to fly, following South Korea, the USA, Canada, and Germany. Infraero, the organization responsible for managing most of the airports in Brazil, oversees key airports located in São Paulo, Rio de Janeiro, and Brasília. In 2023, approximately 115 million passengers were transported.

International passengers are required to clear customs at their first point of entry, which often leads to long queues for immigration at São Paulo airport.

For cargo import and export, customs clearance can be conducted at various airports throughout the country. It is important to note that international cargo planes are not permitted to operate domestic flights; domestic connections must be handled by Brazilian airlines such as TAM, GOL, and AZUL.

2.3.b.ii. The Main Brazilian Airports

International Airports:

1. Aeroporto Internacional de São Paulo/Guarulhos (GRU)

2. Aeroporto Internacional do Rio de Janeiro/Galeão (GIG)

3. Aeroporto Internacional de Brasília (BSB)

4. Aeroporto Internacional de Viracopos/Campinas (VCP)

5. Aeroporto Internacional de Confins/Tancredo Neves (CNF)

6. Aeroporto Internacional de Salvador (SSA)

7. Aeroporto Internacional de Recife/Guararapes (REC)

8. Aeroporto Internacional de Porto Alegre/Salgado Filho (POA)

9. Aeroporto Internacional de Fortaleza/Pinto Martins (FOR)

10. Aeroporto Internacional de Manaus/Eduardo Gomes (MAO)

11. Aeroporto Internacional de Florianópolis/Hercílio Luz (FLN)

12. Aeroporto Internacional de Curitiba/Afonso Pena (CWB)

13. Aeroporto Internacional de Natal/Aluízio Alves (NAT)

14. Aeroporto Internacional de Cuiabá/Marechal Rondon (CGB)

15. Aeroporto Internacional de Belém/Val-de-Cans (BEL)

16. Aeroporto Internacional de Vitória/Eurico de Aguiar Salles (VIX)

17. Aeroporto Internacional de Maceió/Zumbi dos Palmares (MCZ)

18. Aeroporto Internacional de João Pessoa/Presidente Castro Pinto (JPA)

19. Aeroporto Internacional de São Luís/Marechal Cunha Machado (SLZ)

20. Aeroporto Internacional de Teresina/Senador Petrônio Portella (THE)

21. Aeroporto Internacional de Aracaju/Santa Maria (AJU)

22. Aeroporto Internacional de Palmas/Brigadeiro Lysias Rodrigues (PMW)

23. Aeroporto Internacional de Boa Vista/Atlas Brasil Cantanhede (BVB)

24. Aeroporto Internacional de Porto Velho/Governador Jorge Teixeira de Oliveira (PVH)

25. Aeroporto Internacional de Rio Branco/Plácido de Castro (RBR)

Important Regional Airports:

1. Aeroporto de São Paulo/Congonhas (CGH)

2. Aeroporto de Santos Dumont (SDU)

3. Aeroporto de Pampulha – Belo Horizonte (PLU)

4. Aeroporto de Uberlândia/Ten. Cel. Av. César Bombonato (UDI)

5. Aeroporto de Londrina/Governador José Richa (LDB)

6. Aeroporto de Joinville/Lauro Carneiro de Loyola (JOI)

7. Aeroporto de Navegantes/Ministro Victor Konder (NVT)

8. Aeroporto de Foz do Iguaçu/Cataratas (IGU)

9. Aeroporto de Maringá/Regional Silvio Name Junior (MGF)

10. Aeroporto de Campo Grande (CGR)

11. Aeroporto de Goiânia/Santa Genoveva (GYN)

12. Aeroporto de Macapá/Alberto Alcolumbre (MCP)

13. Aeroporto de Santarém/Maestro Wilson Fonseca (STM)

14. Aeroporto de Imperatriz/Prefeito Renato Moreira (IMP)

15. Aeroporto de Marabá/João Correa da Rocha (MAB)

16. Aeroporto de Altamira (ATM)

17. Aeroporto de Tabatinga (TBT)

18. Aeroporto de Cruzeiro do Sul (CZS)

19. Aeroporto de Parnaíba/Prefeito Dr. João Silva Filho (PHB)

20. Aeroporto de Parintins (PIN)

Smaller/Low Traffic Airports:

1. Aeroporto de Paulo Afonso (PAV)

2. Aeroporto de Carajás (CKS)

3. Aeroporto de Tefé (TFF)

4. Aeroporto de Rio Grande (RIG)

5. Aeroporto de São José dos Campos (SJK)

6. Aeroporto de Juazeiro do Norte/Orlando Bezerra de Menezes (JDO)

7. Aeroporto de Campina Grande/Presidente João Suassuna (CPV)

8. Aeroporto de Montes Claros/Mário Ribeiro (MOC)

9. Aeroporto de Dourados (DOU)

10. Aeroporto de Pelotas (PET)

2.3.c. Water Transportation

2.3.c.i. Characteristics

Brazil has a considerable number of seaports, which play a crucial role in the country’s foreign trade. However, cabotage (transport between different Brazilian territories) remains underutilized, despite its potential to reduce logistical costs and alleviate road congestion. Similarly, the transportation of cargo via rivers and lakes is underused, with the Amazon region being a notable exception where river transport is more prevalent due to its unique geographical characteristics.

Most maritime shipping companies regularly serve the Brazilian coastline, facilitating the transportation of goods to various international destinations. The transit time to most European ports typically ranges between 14 and 21 days, depending on the port of origin and navigation conditions.

2.3.c.ii. Main Brazilian Ports

Southeast Region

● Porto de Santos (SP)

● Porto de Vitória (ES)

● Porto do Rio de Janeiro (RJ)

● Porto de Sepetiba/Itaguaí (RJ)

● Porto de Angra dos Reis (RJ)

South Region

● Porto de Paranaguá (PR)

● Porto de Antonina (PR)

● Porto de Rio Grande (RS)

● Porto de Itajaí (SC)

● Porto de São Francisco do Sul (SC)

● Porto de Imbituba (SC)

Northeast Region

● Porto de Suape (PE)

● Porto de Salvador (BA)

● Porto de Aratu (BA)

● Porto de Maceió (AL)

● Porto de Recife (PE)

● Porto de Fortaleza (CE)

● Porto de Natal (RN)

● Porto de Cabedelo (PB)

● Porto de Itaqui (MA)

North Region

● Porto de Manaus (AM)

● Porto de Belém (PA)

● Porto de Santana (AP)

● Porto de Santarém (PA)

● Porto de Porto Velho (RO)

● Porto de Macapá (AP)

● Porto de Itacoatiara (AM)

● Porto de Trombetas (PA)

Central-West Region

● Porto de Ladário (MS)

● Porto de Corumbá (MS)

Smaller and Specialized Ports

● Porto de Porto Alegre (RS)

● Porto de Pelotas (RS)

● Porto de São Sebastião (SP)

● Porto de Navegantes (SC)

● Porto de Ilhéus (BA)

● Porto de Itapoá (SC)

● Porto de Aracaju (SE)

● Porto de Forno (RJ)

● Porto de Areia Branca (RN)

● Porto de Caravelas (BA)

Characteristics and Functions

● Porto de Santos (SP): The largest and busiest port in Latin America, vital for importing and exporting containers, agricultural, and industrial products.

● Porto de Paranaguá (PR): Known for exporting grains, soybean meal, and frozen products.

● Porto de Rio Grande (RS): Important for exporting agricultural and industrial products in the South region.

● Porto de Itajaí (SC): Focused on containers and exporting meat and manufactured goods.

● Porto de Suape (PE): Modern with advanced infrastructure, serving the Northeast region, especially for fuels and chemicals.

● Porto de Vitória (ES): Crucial for the Southeast, handling minerals, steel products, and coffee.

● Porto de Manaus (AM): Strategic for the North region due to the Manaus Free Trade Zone, facilitating the transport of industrial and electronic products.

● Porto de Salvador (BA): Exports chemicals, petrochemicals, and cellulose, serving the Northeast region.

Benefits and Challenges

Benefits:

● High cargo handling capacity.

● Facilitates access to global markets, strengthening Brazil’s foreign trade.

● Maritime transport is economical for large volumes of cargo over long distances.

Challenges:

● Need for modernization and expansion to increase efficiency.

● Complex and time-consuming processes that increase costs and dispatch times.

● Congestion issues that impact operational efficiency.

● Insufficient integration between waterway transport and other modes, limiting logistical efficiency.

2.3.d. Road Transport

2.3.d.i. Characteristics

Brazil has over 107,000 km of highways, with approximately 19,500 km privately managed (with tolls) and around 87,500 km publicly managed (free of charge). About 43% of the highways are in good or excellent condition, while 57% present issues. Roads in the South and Southeast regions are generally in better condition compared to other areas. Road transport is the primary mode of transportation in Brazil, responsible for the majority of cargo and passenger movement.

Benefits for Foreign Trade

● Flexibility: Allows for the direct transportation of various types and sizes of goods to their final destination.

● Accessibility: Reaches areas inaccessible by other modes of transport, facilitating the internal distribution of imported and exported goods.

● Speed: For short and medium distances, road transport can be faster than other modes.

Challenges

● Deficient Infrastructure: The varying quality of roads affects efficiency and increases vehicle maintenance costs.

● High Costs: Toll fees, fuel expenses, and vehicle maintenance contribute to higher logistics costs.

● Security: The risks of accidents and cargo theft are ongoing concerns.

2.3.e. Rail Transport

2.3.e.i. Characteristics

The Brazilian railway system is old and in need of modernization. Historically, the emphasis has been on road transport, leading to insufficient investments in railways. However, the private sector has been making efforts to reverse this trend, with significant investments projected for the coming years. Railways in Brazil are predominantly used for freight transport, particularly for agricultural products, minerals, and fuels.

Benefits for Foreign Trade

● Cargo Capacity: Ideal for transporting large volumes of cargo over long distances.

● Energy Efficiency: Lower fuel consumption per ton transported compared to road transport.

● Lower Environmental Impact: Reduces CO2 emissions and other pollutants.

Challenges

● Outdated Infrastructure: A pressing need for modernization and expansion of the railway network.

● Multimodal Integration: The lack of integration with other transport modes limits logistical efficiency.

● Necessary Investments: Urgent need for both public and private investments to upgrade and expand the railway infrastructure.

2.4. Import Cost Structure

The cost structure of imports in Brazil is complex due to the numerous taxes, fees, and charges that apply to imported goods. For companies engaged in foreign trade, understanding these costs is crucial, as they have a direct impact on the final price of imported products.

2.4.a. Taxes

2.4.a.i. Import Duty (II)

● Description: The Import Duty (II) is a federal tax with protective purposes, varying according to the goods, country of origin, and tariff classification.

● Calculation Formula: II = Import Duty Rate × Customs Value

● Note: The customs value includes the cost of the goods, international freight, and insurance.

2.4.a.ii. Tax on Industrialized Products (IPI)

● Description: The IPI is a federal tax that applies to industrialized products, varying according to the product classification.

● Calculation Formula: IPI = IPI Rate × (Customs Value + II)

● Credit: Depending on the importer’s tax status, this tax can be credited against the tax payable on future sales.

2.4.a.iii. PIS and COFINS – Social Contributions

● Description: The Social Integration Program (PIS) and the Contribution for Social Security Financing (COFINS) are social contributions used to finance social security.

● Calculation Formulas: PIS = PIS Rate × (Customs Value + II + IPI + ICMS)

● Credit: These taxes can be credited against the tax payable on future sales, depending on the company’s tax regime (cumulative or non-cumulative).

2.4.a.iv. Tax on the Circulation of Goods and Services (ICMS)

● Description: The ICMS is a state tax that varies according to the destination state.

● Calculation Formula: ICMS = ICMS Rate × (Customs Value + II + IPI + ICMS + PIS + COFINS)

● Credit: This tax can be credited against the tax payable on future sales.

2.5 Incentives for International Trade

2.5.a. Export Incentives

Exports in Brazil continue to benefit from a range of tax incentives that have remained stable and, in some cases, have been strengthened between 2018 and 2023. Exports are exempt from ICMS (Tax on the Circulation of Goods and Services) and IPI (Tax on Industrialized Products), which enhances the competitiveness of Brazilian products in the international market. Additionally, depending on the company’s tax status, exports may also be exempt from PIS (Social Integration Program) and COFINS (Contribution for Social Security Financing), further reducing export costs.

Companies that utilize trading companies to facilitate exports remain eligible for the same tax benefits, offering flexibility and efficiency in foreign trade operations. Domestic sales to Free Trade Zones (ZLCs), such as the Manaus Free Trade Zone, continue to be tax-exempt, fostering industrialization and economic development in these regions. As of 2023, the Brazilian government continues to support these policies to promote export growth, particularly in strategic sectors such as agribusiness, technology, and manufacturing.

2.5.b. Import Incentives

Between 2018 and 2023, several Brazilian states, including Espírito Santo, Santa Catarina, and others, have maintained and even expanded tax incentives for import activities, aiming to attract investments and foster local economic development. These states offer reductions in the ICMS (Tax on the Circulation of Goods and Services) rate, which can lead to significant cost savings for importing companies.

Moreover, in 2023, new policies were implemented to encourage the importation of strategic inputs, with the goal of strengthening the national production chain. These measures are particularly crucial during periods of global shortages of certain materials, ensuring that the Brazilian industry has access to essential resources. Companies looking to enter or expand in the Brazilian market should take these regional incentives into account, as they can offer substantial competitive advantages and reduce operational costs.

2.6. Corruption

2.6.a. Introduction

Corruption continues to pose a significant challenge for Brazilian society. In 2023, Brazil maintained its position on the Corruption Perceptions Index, remaining far from the top ranks, which reflects the ongoing nature of the issue. While corruption was more rampant in past decades, there have been gradual improvements in recent years. Several high-profile scandals involving politicians and business leaders since 2018 have led to severe punishments, contributing to the erosion of the culture of impunity. The increased public exposure and media coverage of these cases have also played a crucial role in shifting attitudes, fostering greater awareness and driving demand for reforms.

In foreign trade operations, the implementation of online systems such as SISCOMEX and RADAR has made corrupt practices more challenging. These platforms provide enhanced transparency and traceability of transactions, reducing the opportunities for corruption that typically arise during direct personal interactions. Additionally, they enable greater oversight and control by authorities, further mitigating the risk of corrupt activities.

2.6.b. Recommendations on handling corruption

In the context of import and export operations, corruption typically arises when there are flaws or inconsistencies in procedures. When all documentation is accurate, the cargo is properly legalized, and all relevant information is provided in a timely and correct manner, it is rare for a tax authority to request a bribe. Most customs officials in Brazil conduct themselves with integrity and professionalism.

To avoid situations of corruption, it is crucial for companies to adhere strictly to documentation standards and comply with all bureaucratic requirements. If an issue arises and an attempt at corruption occurs, it is important to remain calm and pursue a legal resolution. Agreeing to pay a bribe can initiate a vicious cycle that is difficult to break, so it is best to avoid this route from the outset. Strengthening compliance and following legal procedures are the most effective defenses against corruption in foreign trade operations.

2.7. Common Mistakes in the Foreign Perspective on Brazil

2.7.a. Brazil is a Cheap Country

Foreigners often develop the mistaken impression that Brazil is a cheap country, particularly after experiencing vacations on Brazilian beaches, where the cost of items like shrimp or a coconut may seem very affordable compared to other countries. However, this perception does not accurately reflect the broader economic reality of the country. While wages in Brazil are generally lower than in Europe or North America, the social and tax burdens on companies can exceed 100%, significantly impacting operational costs.

Furthermore, the cost of raw materials, components, and machinery required for production in Brazil can be quite high. Even when certain products are manufactured locally, domestic production often struggles to meet demand, leading to elevated prices. This is particularly evident in sectors like steel, where, despite Brazil being one of the world’s largest steel producers, domestic prices are often higher than international rates due to factors such as inadequate infrastructure, high logistical costs, and heavy tax burdens.

Thus, while some aspects of daily life in Brazil may appear inexpensive, the cost of doing business and industrial production can be substantially higher, especially when involving imported inputs or capital goods. This complex economic landscape should be carefully considered by foreign companies planning to invest or operate in Brazil to avoid financial surprises and ensure the viability of their operations.

2.7.b. It is easy to move around

The perception that getting around Brazil is easy is mistaken, particularly for foreigners. In reality, mobility across the country can be quite challenging due to several factors. Road conditions vary significantly; in many regions, especially in the North and the interior, roads are poorly maintained, and signage is inadequate, making navigation difficult. Even in states like São Paulo and Rio de Janeiro, where road infrastructure is more developed, problematic stretches still exist.

Although GPS coverage is generally good in major cities, relying on it can lead to unexpected risks. It’s common for GPS to direct drivers to dangerous areas, such as favelas, which can be particularly risky for those unfamiliar with the region. Therefore, it is crucial to stay alert and, when possible, use well-known routes or updated maps to avoid these situations.

Rail transport in Brazil is limited and, in most parts of the country, practically nonexistent for passengers. Where train services do exist, they are typically old and inefficient, with infrastructure that falls short of modern transportation needs.

On the other hand, the air transport system in Brazil is relatively safe and has seen significant modernization in recent years, especially in major airports like Guarulhos (São Paulo) and Viracopos (Campinas), which have opened new terminals and improved facilities. However, the rapid growth in passenger numbers has led to frequent delays and congestion at many airports. While air transport offers a viable solution for long distances, the limitations in other modes of transportation make getting around Brazil a significant challenge for both residents and visitors.

2.7.c. Brazil is Merely a Commodity Exporter

While Brazil is widely recognized as one of the world’s largest exporters of commodities such as beef, soybeans, coffee, and sugarcane for ethanol production, the country also boasts a diversified industrial base that extends far beyond these raw materials. Embraer, for instance, is a globally renowned Brazilian company and a leader in the production of regional jets with a capacity of 70 to 100 seats. In addition to this, Brazil exports a wide range of other manufactured products, including automobiles, machinery, cell phones, and electronics. These exports highlight Brazil’s ability to compete on the global stage in high-tech and complex sectors, challenging the perception that the country is merely a commodity exporter.

2.7.d. Pricing of products

The Brazilian tax system is notoriously complex, making it challenging for foreigners to fully grasp the pricing structure. Many might assume that importers are adding exorbitant profit margins, but this perception is often inaccurate. In reality, the tax burden varies significantly depending on each company’s specific tax situation, which directly influences product pricing. For instance, two companies selling the same product at the same price may have vastly different profit margins, affected not only by their operational efficiency but also by their tax circumstances.

This complexity means that if a foreign company finds its prices uncompetitive in Brazil, it could be facing an unfavorable tax environment. In such cases, consulting a local tax expert is highly recommended to explore potential tax optimizations and enhance price competitiveness in the Brazilian market.

2.7.e. Locations

While São Paulo is Brazil’s primary economic hub, the idea that business activities are confined to this city, with places like Rio de Janeiro, Recife, and Salvador serving merely as tourist destinations, is incomplete. Other regions in Brazil, particularly the South and Northeast, host important industrial and technological hubs that offer significant opportunities for businesses. Cities such as Curitiba, Porto Alegre, Fortaleza, and Recife have emerged as leaders in sectors like technology, agribusiness, and manufacturing.

Moreover, factors such as security, quality of life, infrastructure, and operational costs should be carefully considered when choosing a business location in Brazil. Often, regions outside the São Paulo-Rio axis provide competitive advantages, including lower costs and tax incentives, making them attractive options for companies looking to expand their operations. Therefore, it is crucial to look beyond São Paulo and explore the diverse opportunities that other regions of Brazil have to offer.

2.7.f. Size of the Country

Brazil is one of the largest countries in the world, with an area of approximately 8.5 million square kilometers, making it 200 times larger than Switzerland and nearly twice the size of the European Union. This vast territory means that distances within the country are significant, which must be carefully considered when planning logistics and distribution. For instance, a flight from São Paulo to Europe can take around four hours just to exit Brazilian airspace, and driving from São Paulo to the border with Uruguay in the south covers about 1,500 kilometers, requiring at least two days of travel.

These extensive distances directly impact logistical efficiency and the selection of commercial partners. Companies operating in Brazil must carefully account for the distance factor when planning their operations, ensuring that their logistics and distribution strategies are well-suited to cover the vast areas involved. This includes strategic choices for distribution center locations, planning transport routes, and selecting logistics partners capable of operating effectively across such a large and diverse country.

2.7.g. Culture

Brazilian culture is incredibly diverse, a result of the country’s vast size and its rich history of immigration. This diversity is evident in the various cultural influences found across different regions: Bahia, for example, has strong African roots, while the far South of Brazil, particularly in Rio Grande do Sul, reflects traditions reminiscent of Argentina, with its gaucho practices. In the South, cities like Blumenau and Pomerode showcase German and Italian heritage through their architecture and festivals.

São Paulo, on the other hand, is home to the largest Japanese community outside of Japan, particularly in the Liberdade neighborhood, where Japanese culture and cuisine are predominant. Across Brazil, culture manifests in unique ways, making the country a true melting pot of races, religions, and traditions. This cultural diversity is one of Brazil’s greatest strengths, with each region offering a distinct and enriching cultural experience.

2.7.h. Language

Brazil is the only country in South America that speaks Portuguese, and the language differs from European Portuguese in both accent and vocabulary. This distinction means that when translating materials for the Brazilian market, it is crucial to use a Brazilian translator, as translations by European Portuguese speakers may result in texts that are not entirely suitable for Brazilians.

English is not widely spoken in Brazil, and although Spanish is similar to Portuguese, it is not easily understood by most Brazilians. A recent study revealed that only 8% of Brazilian business professionals are fully proficient in English, 17% speak it fluently but with some errors, and 24% have basic knowledge. Among the general consumer population, only 13% can communicate or understand English, underscoring the importance of tailoring communication to the Brazilian audience.

2.7.i. The Brazilian Domestic Market is Poor

With a population of approximately 213 million people in 2023, Brazil remains a significant market characterized by economic diversity that reflects its vast territory and population. About 10% of the Brazilian population has a purchasing power comparable to the European average, representing roughly 21 million people, nearly three times the population of Switzerland. This group forms a strong consumer market, with a keen interest in higher value-added products and services.

In recent years, Brazil has witnessed a gradual rise in the middle class, which now constitutes a substantial portion of the population. Approximately 75% of Brazilians are considered middle class, a segment that has seen an increase in purchasing power and a growing demand for a wider variety of goods and services.

Author’s: Victor Albert Batista da Silva e Lucilene Aparecida Queiroz

Forvm Comércio Exterior Ltda

Rua Jaroslau Clemente Pesch, 34 Floresta, Joinville, Santa Catarina, Brasil Site:

Phone: +55 (47) 3433 0641

E-mail: [email protected]