I. INTRODUCTION

Electrical energy is one of the main inputs for the Brazilian industry, and the safety of its supply and its cost are determining and essential factors for the competitiveness of Brazilian products.

According to estimates, factories account for approximately 35% of the country’s electrical energy consumption (base year 2024).

I.I. THE BRAZILIAN ELECTRICAL INDUSTRY

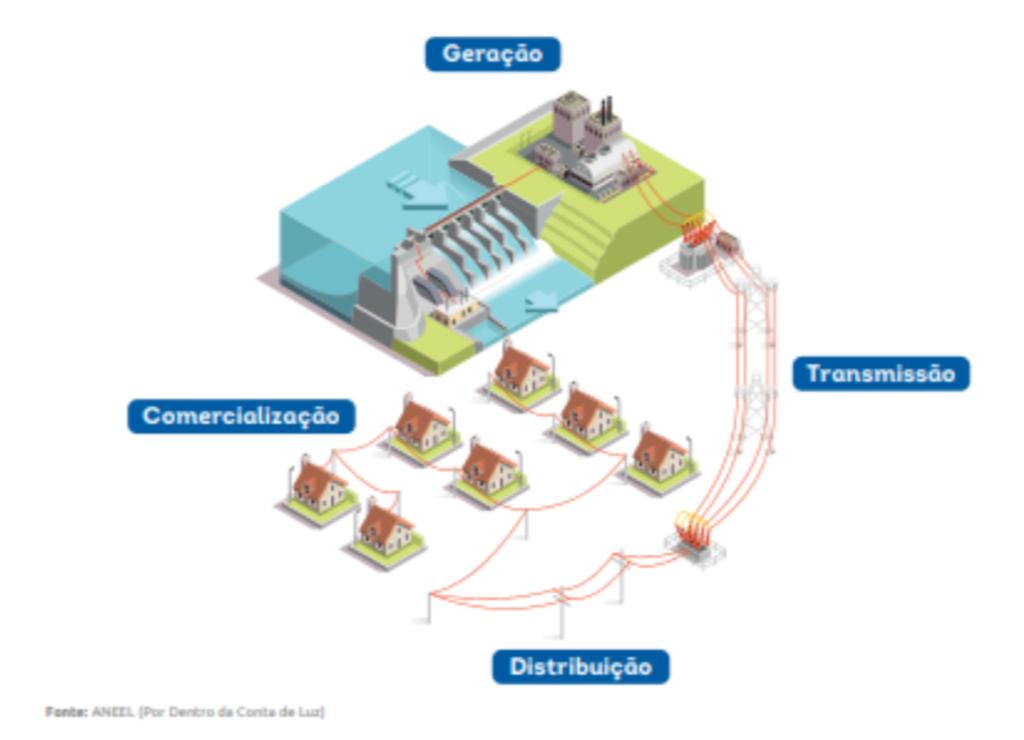

In Brazil, the electrical industry is divided into: generation, transmission, distribution, and trading*.

- Generation: is the segment of the electricity industry responsible for producing electrical energy and feeding it into the transportation systems (transmission and distribution) for it to reach consumers.

- Transmission: is the segment that transports large amounts of energy from the generating plants. Transmission is responsible for delivering energy to the distributors.

- Distribution: receives the energy from the transmission system and distributes it at retail to consumers.

- Trading: Trading companies purchase energy by means of bilateral contracts in the free environment, and they may resell this energy to free or special consumers or to other traders. They may also resell to distributors, in this case only in auctions conducted in the regulated environment.

Legend (clockwise):

Generation

Transmission

Distribution

Trading

Source: ANEEL (Por Dentro da Conta de Luz)

The Industry is also composed of the National Interconnected System (SIN), which is a large chain, extending over a large part of the Brazilian territory, congregating generation systems and an electrical transmission network, which is divided into 4 subsystems: Northeast, Southeast/Central West, South, and North.

Legend (clockwise):

Northeast

South

Southeast/Central West

The Amazon Region

North

Source: ANEEL

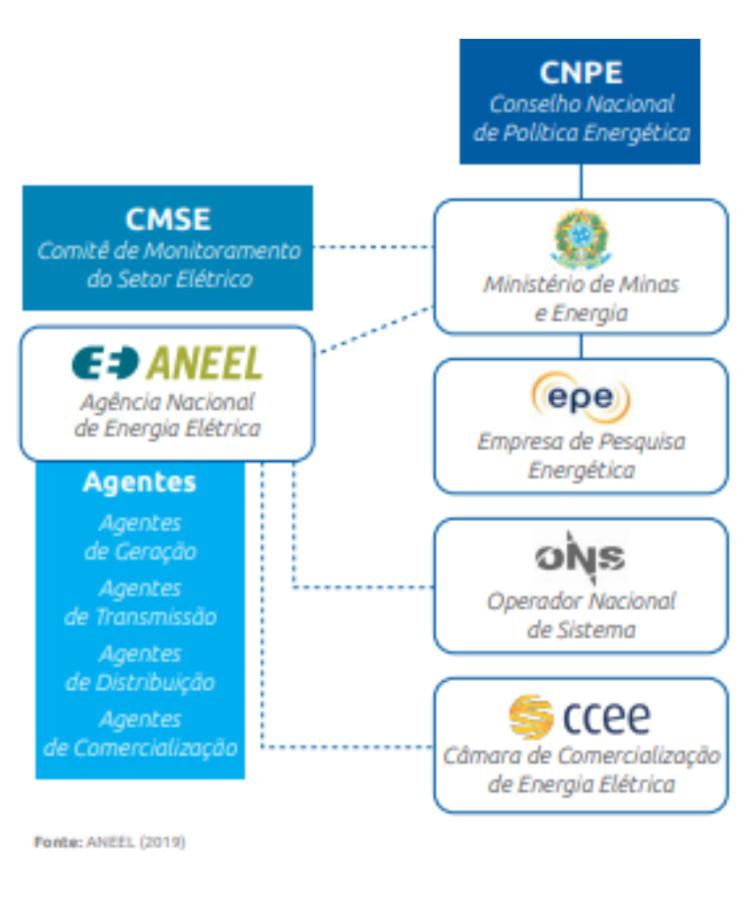

Finally, the organization chart below presents the institutions and organization of the Brazilian electrical industry, which are responsible for the governance and organization of such industry:

Legend:

Column 1

CMSE – Electrical Industry Monitoring Committee

ANEEL – Brazilian Electrical Energy Agency

Agents

Generation Agents

Transmission Agents

Distribution Agents

Trading Agents

Column 2

Ministry of Mines and Energy

EPE – Empresa de Pesquisa Energética [Energy Research Company]

ONS – National System Operator

CCEE – Electric Energy Trading Chamber

Source: ANEEL (2019)

I.I.1 Contracting Environments – Energy Markets

The Electrical Industry is divided into two energy contracting environments, to wit: (i) captive market and (ii) free market.

- Captive Market or Regulated Contracting Environment – ACR: in the captive market, consumers may only purchase energy from local distributions that hold a concession to sell energy in that region. The captive market is estimated to account for 57% of the total consumption of energy in Brazil (base year 2024).

- Free Market or Free Contracting Environment – ACL: in the free market, consumers purchase energy directly from the generators or traders, through bilateral contracts with freely negotiated conditions, such as price, term, and volume. The free market is estimated to account for 43% of the total consumption of energy in Brazil and for 85.5% of industrial consumption (base year 2024).

I.I.2. Functioning of the Energy Market – Summary Scenario

The energy market is complex and there are a number of agents that act in the various phases of the electricity circulation chain, from generation to consumption, as shown above.

The most common agents are generators, transmitters, distributors, traders, and consumers. There are two energy contracting environments, the regulated and the free market.

Generators may operate in both environments, and they are responsible for producing electrical energy.

The transmitters transport electrical energy in high voltage to the consumer centers, but do not sell energy. Thus, they do not operate in either market.

Distributors operate only in the regulated/captive market, they lower the voltage and supply electrical energy to consumers. They sell and physically deliver energy to captive consumers and only physically deliver the energy to free consumers.

Traders operate in the free contracting environment (free market) and may engage in a variety of activities: customer representation, management, intermediation, and purchase and sale of energy.

Consumers are the purchasers of electrical energy, and they may be divided into captive and free consumers. Captive consumers only purchase energy from the distributors, through the electrical grid to which they are connected. Free consumers may purchase energy from the generators or traders, to which they pay for the price of energy, but continue to pay the distributors for use of the electrical grid.

I.I.3. Composition of the electrical energy tariff

The electrical energy tariff shall guarantee the supply of energy with quality and ensure the service providers sufficient revenue to cover efficient operational costs and remunerate investments required to expand capacity and guarantee the supply to individuals and legal entities.

The electrical energy tariff is composed of the amounts of investment and technical operations carried out during the generation, transmission, distribution, and trading processes, in addition to the sectorial charges and taxes (ICMS, PIS/COFINS, and Public Lighting Contribution), as explained in further detail below.

A.1. Costs relating to Electrical Energy Supply

With respect to the costs involved in the supply of energy, which are assessed for composition of the tariffs, we note 3 different costs, which relate to:

- purchase of electrical energy (Purchased Energy) – the value of the generation of energy purchased by the distributors for resale to their consumers is determined in public auctions, which ensures transparency of cots, competitiveness, and best prices;

- use of the distribution system and use of the transmission system (Transport of energy to the consumer units (transmission and distribution) encompassing the specific tariffs (TUST and TUSD) that remunerate the use of infrastructure – The costs involved in the transmission of electrical energy are those related to the transport of energy from the generating units to the distribution systems, and they are composed of the following items:

- use of the transmission facilities classified as Basic Grid, Border Basic Grid, or Other Transmission Facilities (DIT) of shared use,

- use of the distribution facilities,

- connection to DIT of exclusive use,

- connection to the distribution grids,

- transport of the energy originating from Itaipu to the point of connection to the Basic Grid, (vi) use of the Basic Grid by the Itaipu plant, and

- use of the transmission system by the power plants connected at a voltage level of 88 kV or 138 kV.

The costs involved in the distribution activity (entirely managed by the distributors), in turn, are costs related to the investments they made, in addition to the share of depreciation of their assets and the regulatory remuneration

A.2. Sectorial Charges

Despite being established by laws to enable the implementation of public policies in the Brazilian electrical sector, their amounts are set forth in resolutions or orders of the Brazilian Electrical Energy Agency (ANEEL) and are paid by the distributors through electricity bills. There are approximately 18 sectorial charges and fees that are therefore, included in the electrical energy tariff. Among these 18 charges, the Incentive Program for Alternative Sources (PROINFA) and the Energy Development Account (CDE) stand out, with the latter being the most significant in terms of relevance and value.

PROINFA aims to increase the participation of renewable sources, such as Small Hydroelectric Plants, wind energy, and biomass thermal plants, in electricity production. The funding for these projects is divided into monthly quotas, collected by distributors, transmission companies, and licensed cooperatives. The calculation of the quotas is based on the Annual PROINFA Plan (PAP) prepared by ENBPAR and submitted to ANEEL. The amounts are paid by all free and regulated consumers of the National Interconnected System (SIN), except those classified as low-income.

The CDE, in turn, is subdivided into 8 sub-items, the most important of which are the following: Fuel Consumption Account (CCC), which is a payment made to the isolated systems in consideration of the use of high-cost fossil fuels for power generation; Incentivized Sources – Distribution Tariff Discounts (Incentivized Sources), Low Income – Social and Electrical Energy Tariff (TSEE), which represents discounts from 10% to 100% in the energy tariffs of low-income residential consumers.

It is estimated that more than thirty percent (30%) of the electricity bill is due to the cost of energy.

Both CDE and PROINFA are expected to continue at least until 2030, with potential adjustments over time in line with new public policies.

B. Tariff Flags

The main function of the 5 Tariff Flags (green, yellow, red – levels 1 and 2 and water scarcity level) is to balance the costs of distributors with the acquisition of energy of higher value, especially from thermal plants, which occurs more frequently in times of water crisis. The flags signal to the consumer, month by month, the real cost of electricity generation that will be charged to consumers, providing them an opportunity to adjust their consumption, if desired.

C. Taxes

In addition to the tariff, the Federal, State, and Municipal Governments charge on the electricity bill PIS/COFINS, ICMS, and the Public Lighting Contribution, respectively. Of these, the ICMS is the tax with the greatest impact on the electricity bill, with rates varying depending on the state and municipality.

Federal Taxes: The Social Integration Program (PIS) and the Social-Security Financing Contribution (COFINS) are taxes levied by the Federal Government, which are intended for the worker and for the Federal Government’s social programs.

State Tax: The Tax on the Circulation of Goods and Services (ICMS) is a state tax. As provided in article 155 of the 1988 Brazilian Federal Constitution, the tax is levied on transactions relating to the circulation of goods and services, and each State and the Federal District are empowered to define its rates. Distributors are required to charge the ICMS directly in the electricity bill and transfer the amount to the State Government. It is the tax with the greatest impact on the electricity bill.

Municipal Tax: The Public Lighting Contribution (CIP) is provided in article 149-A of the Brazilian 1988 Federal Constitution, which establishes, among the powers of the municipalities, the power to provide on the form of collection and the tax base of the CIP, by means of a specific law approved by the City Council. Therefore, the Municipal Government is solely and exclusively responsible for services involving the planning, implantation, expansion, operation, and maintenance of public lighting facilities. In this case, the concessionaire only collects the public lighting contribution for the municipality. The respective amounts are transferred even if the consumer does not pay the electricity bill.

The taxes above are the main taxes levied on electricity bills and vary according to the location, depending on the municipality and the state.

In the Section below we will describe in further detail the taxes levied on the electricity bill of the taxpayers. We note, however, that those who wish to obtain the detailed values of each of the taxes and charges with rates and impact on the amount paid in the electricity bill may check them in the electricity bills or in the tables provided by the concessionaires on their websites, as determined by ANEEL.

II. SPECIFIC TAXATION ON ELECTRICAL ENERGY

II.I FEDERAL TAXES: Social Integration Program (“PIS”) and Social Security Financing Contribution (“COFINS”)

Power supply transactions are subject to the levy of PIS and COFINS at the combined rate of 9.25% (non-cumulative regime) on the transaction price.

A) Controversy regarding the crediting of contracted versus consumed energy

Legal entities subject to the non-cumulative regime as per the legislation (Law No. 10,637/2002 and Law No. 10,833/2003), may deduct credits in relation to “electrical energy and thermal energy, including in the form of steam, consumed in the establishments of the legal entity”.

Please note that electrical energy expenses entitle the legal entities to a credit irrespective of the sector or establishment of the company where the electricity is being consumed, encompassing all premises used, irrespective of their purpose (operational area, accounting, management, etc.). We further note that in these transactions, the credit shall only be granted if the energy is paid to Legal Entities domiciled in Brazil.

In recent years, there have been debates at the Conselho Administrativo de Recursos Fiscais (CARF) regarding the possibility of including payments for “contracted demand”—that is, the reservation of power capacity beyond the actual energy consumed—as part of the credit base for PIS/COFINS. The core issue was whether the mandatory payment for the minimum demand stipulated in the contract could generate PIS/COFINS credits. Up to 2023, there were isolated decisions admitting this right.

In 2020, CARF recognized the possibility of credits related to “expenditures on contracted demand, included in the electricity bill”, as these are “mandatory, aimed at the effective operation of the establishment, and have a social character… (CARF Decision 3201-007.441, dated November 17, 2020)”.

However, this understanding was overturned in July 2023, when the Superior Chamber of Tax Appeals, by majority, ruled that the amounts paid for contracted demand and for the use of the distribution system are not considered consumed energy; rather, they represent the amount paid by the user to the concessionaire to keep the network (means) available for electricity consumption. In this case, the prevailing understanding was that only the energy effectively consumed generates PIS/COFINS credits (CARF, Process No. 10183.904627/2016-60, Decision No. 9303-014.076 – CSRF / 3rd Panel).

According to the Rapporteur, “contracted demand” refers to “electricity that may not actually flow to the consuming establishment but is stipulated in a contract in which the concessionaire is obligated to make it continuously available.” In contrast, “consumed electricity” is defined as the amount of kWh (kilowatt-hour) or MWh (megawatt-hour) effectively used by a consuming unit in a specific period.

The legal basis for this distinction lies in the restrictive provisions of Article 3, Item IX of Law No. 10,637/2002 and Article 3, Item III of Law No. 10,833/2003, which narrowly list the expenses eligible for PIS/COFINS credits. Consequently, expenses related to contracted demand (power reservation) and other charges, such as the Public Lighting Contribution (COSIP), do not qualify for credits. This position was formalized in CARF Precedent No. 224, approved by the 3rd Panel of the Superior Chamber of Tax Appeals (CSRF) on August 26, 2025, effective from September 1, 2025. The CARF Precedent states:

“For the purposes of calculating credits under the non-cumulative regime of PIS/Pasep and COFINS contributions, only the electricity effectively consumed in the establishments of the legal entity shall be considered, excluding other expenses such as the Public Lighting Contribution (COSIP) or contracted demand.”

Practical Implications:

- Companies can only claim PIS/COFINS credits on the electricity actually consumed, as measured by meters (in kWh), not on the total amount billed, even if it includes mandatory contracted demand exceeding actual consumption. This interpretation is binding in CARF and federal administrative proceedings.

- Contracts stipulating power reservation without corresponding consumption do not allow credits for those amounts, even if the cost is mandatory to enable the company’s operations. Credits are strictly limited to measured consumption.

- This binding precedent applies to federal administrative audits and rulings by the Federal Revenue Service and CARF.

B) Controversy Regarding the Exclusion of ICMS from the PIS/COFINS Calculation Base: Refund of Unduly Paid Amounts

In 2022, Law 14,385 was enacted, which establishes the refund of ICMS included in the calculation bases of PIS and COFINS. This inclusion was deemed unconstitutional in 2017 by the Federal Supreme Court, which ordered the exclusion of this ICMS from those calculation bases and defined that the measure should be retroactive to March 15, 2017. Dissatisfied with this law, electric power distributors filed a Direct Action of Unconstitutionality (ADI) 7,324 challenging it. This ADI was partially upheld in August 2025 by the STF, which validated the constitutionality of Law 14,385/22, establishing a 10-year statute of limitations for consumer claims.

Direct Consequences of the Decision

The partial upholding of ADI 7195 by the Supreme Federal Court (STF) in August 2025, validating the constitutionality of Law 14,385/22, has significant implications for the Brazilian energy sector, particularly regarding the refund of ICMS amounts unduly included in the PIS/COFINS calculation base. Below is a summary of the key outcomes, tailored for investors, directors, and legal professionals, emphasizing the legal, economic, and operational impacts:

- Legal Certainty on Refunds: The decision clarifies that energy distributors are obligated to pass on to consumers the ICMS amounts included in the PIS/COFINS base that were subsequently refunded to them, as regulated by the National Electric Energy Agency (ANEEL). This refund is mandatory, not discretionary, following a uniform national policy. This ruling eliminates disputes over unjust enrichment by concessionaires, ensuring that consumers receive what is rightfully owed

- 10-Year Statute of Limitations: Consumers and their representative entities have a 10-year period to claim refunds for overpaid amounts, starting from the date the undue amounts are refunded to distributors or their final homologation. This extended timeframe resolves prior debates over whether a 5-year or 10-year statute applied, providing broad access to restitution and enhancing consumer protections.

- Cost Deductions by Concessionaires: Distributors are permitted to deduct from the refunded amounts any taxes incurred on the refund process and specific legal fees paid in related litigation. This measure safeguards the economic-financial balance of concession contracts, preventing excessive financial strain on distributors while ensuring fair restitution to consumers.

- ANEEL’s Role in Implementation: ANEEL is tasked with operationalizing the refund process based on approved tariff regulations. Refunds may be automatically credited to future electricity bills for current customers, while former customers no longer in the distributor’s base are entitled to full reimbursement, ensuring equitable access to restitution.

- Significant Economic Impact: Preliminary estimates suggest refunds could exceed BRL 62 billion, providing substantial relief to consumers without the risk of tariff increases stemming from this decision. This outcome supports affordability in electricity costs, a critical factor for households and businesses in the energy-intensive Brazilian market.

- End of Judicial Disputes: By declaring Law 14,385/22 constitutional and establishing clear refund criteria, the STF resolves a long-standing tax controversy in the energy sector. This decision provides regulatory predictability, reducing litigation risks and fostering a stable legal environment for stakeholders

Summary:

Consumers are guaranteed the right to claim refunds for ICMS unduly included in the PIS/COFINS base on electricity bills, with a clear 10-year statute of limitations. Distributors can deduct related tax and legal costs, ensuring contractual balance, while ANEEL oversees the refund process. This ruling enhances regulatory certainty, protects consumer rights, and mitigates financial risks for the sector.

II.II. Tax on the Circulation of Goods and on the Provision of Interstate and Intermunicipal Transportation and Communication Services (“ICMS”)

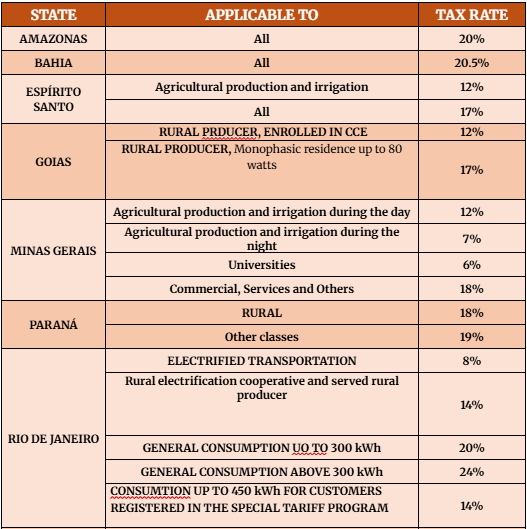

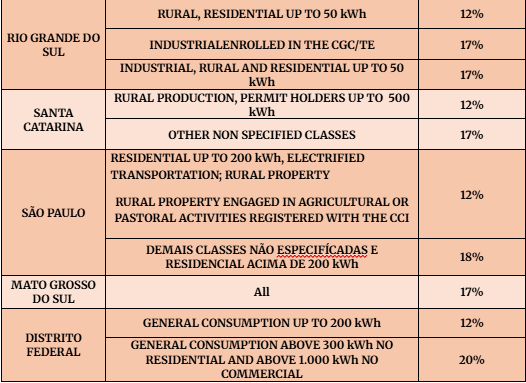

This is the tax with the greatest impact on the price of the Electricity Tariff (TE) and the one that most increases the electricity bill. Starting in 2022, the rates, which previously ranged from 18% to 32%, were reduced to values close to 18% in all states, due to the enactment of Complementary Law 194/22, which included electricity among the goods and services considered “essential and indispensable.”

II.II.1 TAX RATE

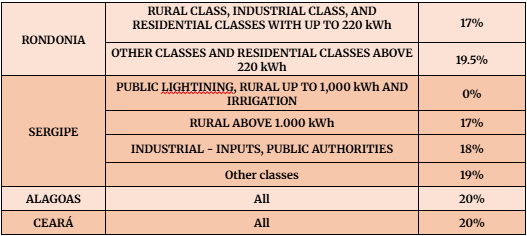

Currently, some examples of ICMS charges and their respective state rates applicable in 2025 can be found in the table below:

*This table may be subject to changes due to legislative modifications in each state.

II.II.2. TAX BASE

II.II.2.A. INTRODUCTION

In general, the ICMS tax base shall correspond to the transaction price – result of the sum of all amounts and charges inherent in the provision of electrical energy for consumption, plus the applicable ICMS amount, which have been charged, on any account, from the person indicated as recipient in the tax document as a result of the performance of an electrical energy supply agreement entered into between such person and the distribution company.

However, electrical energy concessionaires also include the transmission and distribution expenses (Transmission System Use Tariff – TUST and Distribution System Use Tariff) in the ICMS tax base, in addition to the client’s consumption, it being understood that they also add other charges passed on to third parties, which inflates the ICMS tax base, which should be levied only on the actual energy demand.

Due to this practice, our courts discuss whether or not to include the TUSD and TUST tariffs in the ICMS tax base, in which respect there were recent developments.

II.II.2.B Dispute about the Inclusion/exclusion of the Distribution System Use Tariff – TUSD and of the Transmission System Use Tariff – TUST in the ICMS tax base

TUSD (Distribution System Use Tariff) is the consideration paid to the public utility concessionaire for use of these electric systems in the generation and consumption of energy.

TUST (Transmission System Use Tariff), in turn, is the tariff that remunerates the transmission system, and which is paid by the users of the electrical power Basic Grid: generators, distributors, free consumers, and traders that import and export electrical energy. Both the Distribution System Use Tariff (“TUSD”) and the Transmission System Use Tariff (“TUST”) are charged from the consumer of electrical energy, whether in the regulated or in the free contracting environment, and they are paid in consideration of use of the system (“wire usage”).

These tariffs are part of the monthly costs of the National Integrated System (SIN), which produces and transmits electric energy throughout the country.

Since 2017, there has been a judicial discussion before the Superior Court of Justice (STJ) regarding the validity of including these tariffs in the ICMS calculation base. The main argument for excluding the tariffs from the ICMS calculation base is that ICMS is a tax that should apply to the consumption of electric energy. It is argued that both transmission and distribution should be classified as the displacement of energy, thus falling outside the scope of ICMS incidence, as “making energy available” differs from “supplying” energy. Only the supply of energy would fall within the scope of ICMS incidence.

On March 27, 2017, in the records of Special Appeal 1.163.020/RS, the 1st Panel of the STJ changed the previously dominant jurisprudence that favoured taxpayers by ruling in favour of the tax authorities and against the exclusion of TUST and TUSD. The court stated that it is not possible to dissociate the stages of energy supply. It is noteworthy that until March 2017, the orientation of the public law panels of the STJ was favourable to taxpayers. The STJ suspended all processes related to this issue nationwide. The matter was considered of general repercussion, consistent with TOPIC 986/STF – Inclusion of TUST and TUSD in the ICMS calculation base applicable to electric energy. Consequently, the thesis established in the ruling will apply to similar cases pending in all courts across the country, including those that have been suspended.

Subsequently, on March 13, 2024, under the procedure of repetitive special appeals (Topic 986), the First Section of the Superior Court of Justice (STJ) unanimously established that the Tariff for the Use of the Distribution System (TUSD) and the Tariff for the Use of the Transmission System (TUST) must be included in the calculation base of the Tax on Circulation of Goods and Services (ICMS) for electric energy, in situations where they are charged on the electricity bill as a cost to be paid directly by the final consumer—whether they are free consumers (those who can choose their own energy supplier) or captive consumers (those who do not have such a choice).

Since the ruling was made under the repetitive system, the established thesis must be applied to similar cases pending in courts across the country, including actions that had remained suspended until March 2024, awaiting the definition of the qualified precedent by the STJ.

The First Section established that, until March 27, 2017 – the date of publication of the judgment by the First Panel – the effects of preliminary decisions that benefited electricity consumers are maintained, allowing them to collect ICMS without including TUSD and TUST in the calculation base, regardless of judicial deposit. Even in these cases, these taxpayers must begin to include the tariffs in the ICMS calculation base from the date of publication of the judgment on Repetitive Topic 986.

The modulation of effects does not benefit taxpayers under the following conditions: a) without filing a judicial claim; b) with a judicial claim filed, but in which there is no urgent or evident protection (or where any previously granted protection is no longer in effect due to being revoked or modified); and c) with a judicial claim filed, in which the urgent or evident protection has been conditioned on the performance of a judicial deposit.

In the case of judicial claims with final and unappealable decisions, the section considered that these cases must be analyzed individually, through the appropriate judicial channels.

It is noteworthy that the Supreme Federal Court (STF), in a recent decision (May 2025), has solidified the understanding, still regarding Theme 9856, that the Superior Court of Justice (STJ) is the competent instance to judge this matter, thereby eliminating any controversy involving the modulation of the decision by the STJ.

It should be noted that the position adopted by the STJ above covers the period prior to the enactment of Complementary Law No. 194/2022. This Complementary Law, through its Article 2, included Article 3, item X, in Complementary Law No. 87/96, stating that starting in 2022, ICMS shall not be levied upon to TUSD and TUST, as follows:

“Art. 3 The tax shall not be levied on:

X – transmission and distribution services and sectorial charges related to electrical energy transactions. (Included by Complementary Law No. 194 of 2022)”

However, in 2022, various States filed the Direct Action for the Declaration of Unconstitutionality (ADI) No. 7195 before the Brazilian Supreme Court – STF with a request for a preliminary injunction, to challenge the constitutionality of excluding the TUST and TUSD from the ICMS tax base, due to the new wording introduced by Complementary Law 194/22 to article 3, item X of Complementary Law No. 87/96. The states argued that this change infringed on state tax autonomy (Article 155, § 2, XII, “b” of the 1988 Federal Constitution) and caused billion-dollar fiscal impacts, affecting municipal revenue transfers. In a virtual session concluded on March 3, 2023, the STF Plenary upheld the preliminary injunction previously granted by the rapporteur, Justice Luiz Fux, suspending the effectiveness of Article 2 of Complementary Law No. 194/2022. The rapporteur argued that the Federal Government may have exceeded its supplementary legislative authority, interfering with the states’ tax autonomy.

As of September 2025, the merits of ADI 7195 remain pending judgment in the STF. In the meantime, the preliminary suspension maintains the inclusion of TUSD and TUST in the ICMS calculation base, aligning with the STJ’s precedent in Theme 986. Regional and state courts have followed this guidance, ruling against taxpayers in similar cases.

I.II.2.C ICMS on TUST/TUSD – National Jurisprudential Conclusion

In the first half of 2025, the Supreme Federal Court (STF), while examining lawsuits related to the ICMS levied on the tariffs for the use of electricity transmission and distribution systems (TUST/TUSD), recognized that the controversy is of an infraconstitutional nature, as per Theme 986 of the Superior Court of Justice (STJ). Consequently, the prevailing understanding is that the amounts specified for TUST and TUSD in the electricity bill are included in the ICMS calculation base, affecting both captive market consumers and free market consumers, except for taxpayers with final judicial decisions (res judicata) prior to March 27, 2017, whose effects remain valid. This decision impacts all Brazilian state jurisdictions, providing legal certainty to state tax administrations and leaving little room for new judicial disputes.

Main Consequences and Impacts

1 Legal Certainty and Resolution of the Controversy

- The STF’s decision puts an end to one of the most significant tax disputes in the energy sector, definitively validating the STJ’s ruling (Theme 986) that transmission (TUST) and distribution (TUSD) tariffs are part of the ICMS calculation base whenever included in the final consumer’s bill.

- There is no longer scope for new lawsuits seeking the exclusion of these tariffs after March 27, 2017, except in cases with preliminary injunctions or final decisions (res judicata) issued before the publication of that ruling.

2. Fiscal Impact for States

- The ruling prevented billion-dollar losses for state finances. It is estimated that the decision preserves up to BRL 35 billion annually for states by maintaining the inclusion of these tariffs in the ICMS base.

- States that already included these tariffs now operate with definitive legal backing, strengthening the federal pact and regional public budgets.

3. Impact on Companies and Consumers

- Companies that pursued lawsuits or challenges to exclude TUST/TUSD and did not have valid preliminary or provisional decisions as of March 27, 2017, must now calculate, pay, and potentially adjust their systems to mandatorily include these amounts in the ICMS calculation.

- Companies with valid injunctions up to the temporal milestone may continue to benefit until those orders reach final judgment or are revoked. Cases initiated after that date are mandatorily subject to the new regime.

- The decision may generate retroactive tax liabilities for companies that, relying on provisional favorable rulings, failed to collect ICMS on TUST/TUSD after the deadline set by the STJ and STF.

Practical Summary

The decision solidifies the mandatory inclusion of TUSD and TUST in the ICMS calculation base for electricity, preserves significant revenue for state treasuries, eliminates legal uncertainty in the sector, and signals stricter tax compliance for consumers and companies, particularly large consumers and free market agents.

The State of São Paulo, for instance, in response to the impact of the STJ’s decision in Theme 986, launched on April 1, 2025, a self-regularization program targeting 300 electricity consumers, including both regular ICMS taxpayers and non-taxpayers (such as hospitals, shopping centers, and banks), with debts related to the incidence of ICMS on the Tariff for the Use of the Distribution System (TUSD) and the Tariff for the Use of the Transmission System (TUST) for electricity. These consumers can voluntarily regularize their status without penalties. According to the São Paulo State Treasury Department (Sefaz-SP) portal, by July 2025, over BRL 204 million had been collected through this initiative.

II.II.3 INTERNAL AND INTERSTATE ELECTRIC POWER DISTRIBUTION TRANSACTIONS IN THE STATE OF SÃO PAULO

We provide below our comments on the taxation applicable to internal and interstate electricity supply transactions.

The distributors sell and physically deliver energy to captive consumers. To free consumers they only deliver energy, but do not sell it. Therefore, these free consumers purchase energy directly from the generators or traders and pay them for he energy. For that reason, in principle, the generator or traders should be defined by law as ICMS taxpayers de jure.

II.II.3.A SCENARIO UNTIL 2021: JUDICIAL CHALLENGE ON TAX SUBSTITUTION OF DISTRIBUTORS

However, since 2009, the State of São Paulo promoted, through Decree 54.177/09, a change in the ICMS Regulations, providing that the distributors should act as substitute taxpayers and pay the ICMS due by the generators or traders, in the event of sale of energy to the free consumers.

The Decree was challenged in the STF. Direct Action for the Declaration of Unconstitutionality (ADIn) 4281 was filed, which discussed the unconstitutionality of attributing to electrical energy distribution companies, by means of a decree, liability for the payment of ICMS levied on the sales of electrical energy carried out between traders and taxpayers of the State of São Paulo. Please note that this attribution of the capacity as substitute taxpayer of energy distributors resulted in an increase in the ancillary obligations and in the cost of compliance both to the energy distributors and consumers. The ADIN was granted in late 2020 by the STF, which acknowledged especially that only a law in the narrow sense (and not a decree) could transfer tax liability to third parties. The Court modulated the effects of the decision, and it produced effects only after publication of the Appellate Decision, for which reason the law of the State of São Paulo on electrical energy distribution transactions was subject to a deep and amendment in 2021, upon enactment of decrees 65.823/21 (already revoked) and 66.373/21, still in force.

II.II.3.B CURRENT SCENARIO: DECREE 66.373/21- São Paulo changes the ICMS payment system in transactions with Electrical Energy in the Free Contracting Environment (ACL)

The Decree revokes Exhibit XVIII to the ICMS Regulation of the State of São Paulo (RICMS-SP) and consolidates the rules on the matter in articles 425, 425-A to 425-H, and 426 of the RICMS-SP. Ordinance SRE 14/22 introduced the ancillary obligations relating to these provisions.

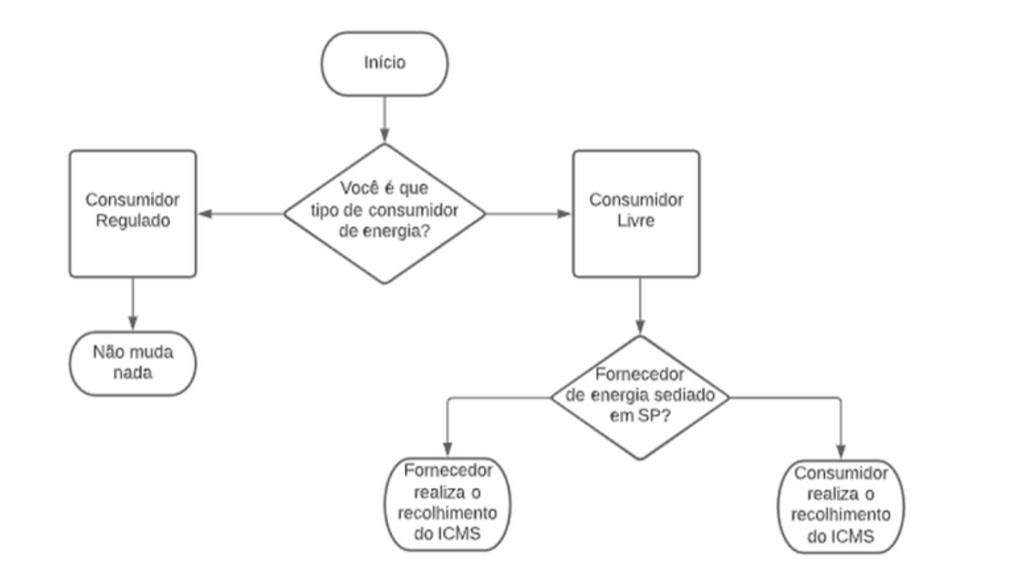

Currently, in light of the above, the collection of ICMS on electricity transactions in the Free Contracting Environment (ACL) in São Paulo has been significantly redefined by Decree 66,373/21 and Treasury Regulation (Portaria SRE) 14/22. The previous model, based on tax substitution by distributors and the mandatory use of the DEVEC (Declaration of Electricity Operations), has been abolished. Now, the responsibility for recording and paying the tax depends on the supplier’s origin: when the supplier (generator or trader) is based in São Paulo, it is responsible for including and collecting the ICMS on the Electronic Invoice issued to the São Paulo consumer. Conversely, if the supplier is located in another state, the responsibility falls to the consumer in São Paulo, who must obtain a state tax registration, issue an inbound invoice, calculate, and pay the ICMS through self-assessment, adhering to the deadlines set by tax legislation.

Additionally, there are specific rules for operations where the consumer is connected to the distribution network (in which case the distributor collects the ICMS related to the connection) or to the basic transmission network (where the consumer is responsible for the tax on network usage charges). The regime also allows adherence to a simplified tax regime for consumers or agents not originally subject to ICMS, provided specific requirements are met, although the use of tax credits is prohibited.

This new framework brings greater clarity, legal certainty, and alignment with recent judicial decisions, while also adapting São Paulo to the best fiscal compliance practices in the electricity sector.

Please see:

Key Points of the Flowchart

- Regulated Consumer (ACR): The flowchart accurately indicates that “nothing changes” — the ICMS model for regulated operations remains unchanged, with the distributor responsible for calculating and collecting the tax.

- Free Consumer (ACL):

- If the energy supplier (generator/trader) is based in São Paulo: The supplier is responsible for collecting and including the ICMS on the invoice.

- If the supplier is located outside São Paulo: The São Paulo consumer (recipient of the energy) is responsible for self-assessing and paying the ICMS, fulfilling specific accessory obligations, after obtaining a state tax registration when necessary.

This framework provides greater predictability, aligns with the STF’s decision in ADI 4281, and reduces disputes over tax substitution, making it crucial for companies in the ACL to ensure fiscal compliance in the state.

II.II.3. C Internal Electrical Energy Distribution Transactions – Tax Rates

As provided in article 52, item V of the RICMS-SP, the following tax rates apply in the State of São Paulo:

- twelve percent (12%) in relation to residential accounts with a monthly consumption of up to two hundred (200) kWh;

- twenty-five percent (25%) in relation to residential accounts with a monthly consumption above two hundred (200) kWh;

- twelve percent (12%) when used in the electrified public passenger transportation;

- twelve percent (12%) in transactions with electrical energy used in rural properties, understood as those that actually maintain agricultural or cattle raising activities and which are enrolled with the ICMS Taxpayers’ Register.

Please note that the tax rates may differ in other States. In the State of Rio de Janeiro, as provided in article 14, item VI of Law No. 2.657/1996, the tax rates applicable to transactions involving electrical energy are the following:

- eighteen percent (18%) for a consumption of up to 300 kilowatts/hour per month;

- twelve percent (12%) for a consumption of up to 450 kilowatts/hour per month for residential clients that fall under the Special Program of Differentiated Tariffs, according to the ANEEL regulation, provided compliance with the requirements and considerations set forth in a Resolution to be published by the Treasury Office;

- twenty-seven percent (27%) for a consumption above 300 kilowatts/hour per month to 450 kilowatts/hour per month;

- twenty-eight percent (28%) if above 450 kilowatts/hour per month;

six percent (6%) when used in the electrified public passenger transportation.

II.II.3.D Electronic Energy Invoice (NF3-e) – New Deadlines and Obligations

The SINIEF Adjustment 03/2025 revised the mandatory implementation schedule for the Electronic Energy Invoice (NF3-e), particularly in the State of São Paulo, extending the deadline for taxpayers’ systemic implementation to October 1, 2025.

This is a critical accessory obligation, requiring the accurate inclusion of taxes (ICMS/TUST/TUSD/PIS/COFINS), adherence to the layouts established by the State and Federal Revenue Services, and integration with the enterprise management systems of the involved agents, under penalty of tax audits and operational restrictions.

The NF3-e represents not only a fiscal and documentary obligation but also a true watershed moment for the standardization, traceability, and transparency of electricity operations in São Paulo, with significant implications from tax, accounting, operational, and regulatory perspectives.

II.II.4.Interstate Electrical Energy Distribution Transactions

Transactions involving the supply of electrical energy to individuals or legal entities in different States are not subject to the levy of ICMS, as provided in article 155, item X, letter “b” of the Brazilian Federal Constitution:

“Art. 155. It is incumbent upon the States and the Federal District to create taxes on:

X – it shall not be levied:

b. on transactions that send oil, including lubricants, liquid and gaseous fuels derived therefrom, and electrical energy to other States.”

However, electrical energy distribution transactions shall only be entitled to said immunity if the acquiring individual or legal entity uses electrical energy to produce goods or provide services intended for trading or manufacturing. That means that pursuant to the provisions of article 2, paragraph 1, item III of Supplementary Law No. 87/96, to benefit from immunity, the energy may not be sold to end consumers.

Please note that there are court rulings in which companies that purchased electrical energy in interstate transactions for use in the manufacturing or sale of other products were deemed end consumers of the energy, and therefore ICMS was levied on such transactions1.

However, in the trial of RE No. 748.543, under the general repercussion system, theme No. 689, the Federal Supreme Court decided that in interstate transactions of supply of electrical energy, only the State of destination is empowered to collect ICMS from end consumers that use the electrical energy in the manufacturing process of products relating to their core activity.

Such appeal became final and unappealable on November 7, 2020, and all proceedings involving this matter in the Brazilian territory shall be tried in accordance with the decision of the Supreme Court.

The STF’s decision in RE 748,543 (Theme 689), finalized in November 2020, established that only the destination state is competent to levy ICMS on interstate electricity supply operations to the final consumer for the industrialization of products related to their core activity. The state of origin is not entitled to impose the tax in these cases.

In practical terms, this means that when an industry purchases electricity from another state for use in its production process, only the destination state (where the consuming company is located) can charge ICMS. The state supplying the energy cannot impose this tax in such situations. This prevents double taxation and ensures that the tax benefits the state where the consumption actually occurs, providing greater certainty for businesses and stability to national tax rules.

This precedent is binding and applicable to all similar cases in Brazil, reinforcing fiscal federalism and benefiting industrial consumers who import electricity from another state for manufacturing their products.

With respect to the tax rates, we provide below, for illustration purposes, the tax rates applicable in the States of São Paulo and Rio de Janeiro:

II.II.3.E. Tax Rates

As provided in article 52, item II and III of the RICMS/SP, the following tax rates apply in the State of São Paulo:

- In interstate transactions destined to the States of the North, Northeast, and Center-West regions and to the State of Espírito Santo: seven percent (7%) and

- In interstate transactions destined to the States in the South and Southeast regions: twelve percent (12%)

There may be a variation in the other States, according to their locations in the Brazilian Regions.

Pursuant to article 14, item III of Law No. 2.657/1996, the following tax rates shall apply to interstate transactions in the State of Rio de Janeiro:

- whenever the recipient, whether or not a taxpayer, is located in the North, Northeast, Center-West regions and in the State of Espírito Santo: seven percent (7%);

- whenever the recipient, whether or not a taxpayer, is located in the other regions: twelve percent (12%).

II.II.4. Simplified Tax Regime in the State of São Paulo

The Simplified Tax Regime for the assessment and payment of tax by recipients, when the taxpayer status arises exclusively from operations with electric energy, is provided for in Ordinance SRE No. 14/2022.

The Simplified ICMS Tax Regime in São Paulo, as provided in Articles 16 to 18 of Treasury Regulation (Portaria SRE) 14/2022 and Articles 425-B, 425-D, and 426 of the São Paulo ICMS Regulation (RICMS-SP), allows free consumers (or sellers, as applicable) to streamline specific accessory obligations in the acquisition of electricity exclusively for consumption, through a formal adhesion agreement, with the trade-off of not being able to claim tax credits for these operations

The Simplified Regime essentially consists of the issuance of an NF-E (Electronic Invoice) and the collection of ICMS, exempting the taxpayer from submitting and delivering the ICMS Information and Calculation Guide – GIA/SP and the Digital Tax Bookkeeping – EFD ICMS-IPI. However, throughout the period during which the recipient is subject to said regime, the use of any credits of such tax shall be prohibited.

II.II.5. EXEMPTION AND TAX BENEFITS

II.II.5.1. Exemption to Rural Producers

There is exemption of ICMS, as provided in Confaz Convention 76/91, on the supply of electrical energy to rural establishments, upon satisfaction of the conditions (engage in agricultural or cattle-raising activities, be enrolled with the ICMS Taxpayers’ Register).

II.II.5.2. Benefits for GD – Distributed Generation – Modalities

There is an ICMS exemption, granted by the States and the Federal District under ICMS Agreement 16/2015, for operations involving distributed generation. The current legal framework allows tax exemptions until December 31, 2032, with a 20% annual reduction in the benefit starting from January 1, 2029, as per applicable national regulations.

In the State of São Paulo, Decree 67,521/2023 amended Article 166 of Annex I of the São Paulo ICMS Regulation (RICMS-SP), extending the ICMS exemption for internal electricity operations by microgenerators and minigenerators to other distributed generation modalities and photovoltaic solar power plants with an installed capacity of up to 5 MW. However, complementary state legislation currently limits this exemption in São Paulo to December 31, 2026. Thus, the effective exemption period in São Paulo is shorter than the federal regime, requiring ongoing monitoring for potential extensions.

Progressive Taxation on Distributed Solar Generation

Notably, the effective charging of the “Wire B” component (Tariff for the Use of the Distribution System) on surplus energy injected into the grid by micro and minigeneration photovoltaic systems connected after January 2023 has begun. In 2025, the charged percentage reaches 45% of the corresponding tariff component, directly impacting the profitability of the compensation model, especially for new projects. A detailed analysis of distribution and distributed generation contracts is recommended to accurately calculate applicable credits and taxes, avoiding surprises in tax obligations and cash flow for investors and consumers.

II.III. MUNICIPAL TAX: PUBLIC LIGHTING SERVICE CONTRIBUTION

This municipal contribution is levied on electrical energy and is named CIP or COSIP, and its purpose is to pay for the municipalities’ public lighting services, improving the lighting of all public roads, squares, viaducts, roads, and tunnels, making them safer.

The CIP varies in accordance with the tax rates established by each municipality. As a general rule, the tax rates are related to the electricity load made available by the concessionaire and the type of consumer. The tariff is also charged to users benefiting from the new social tariff, covered in the next chapter, as long as there is recorded consumption.

III. Universal Free Market and Tax Implications from 2025

Starting in 2025, federal regulations initiated the implementation of the universal opening of the free energy market, establishing a timeline for low- and medium-voltage consumers to choose suppliers in the Free Contracting Environment (ACL). This change impacts the collection of charges and taxes, requiring enhanced tax controls regarding the active liability for ICMS, PIS/COFINS (or CBS/IBS), tax responsibility, and reporting mechanisms to state and federal tax authorities. The new environment demands rigorous contractual analysis to avoid double taxation, ensure accurate appropriation of tax credits, and adapt systems for issuing electronic tax documents for multiple agents.

IV. Tax Implications of Provisional Measure 1,300/2025 on the Electricity Sector Structure

Provisional Measure No. 1,300/2025 represents a profound legislative transformation in the national electricity sector, significantly impacting the tax dynamics related to electricity. Key innovations include the Expansion of the Social Energy Tariff, which now guarantees full exemption from payment for consumers enrolled in federal social programs, indigenous communities, quilombolas, and elderly beneficiaries of the Continuous Cash Benefit (BPC), provided monthly consumption does not exceed 80 kWh. This exemption redistributes the fiscal cost to the broader consumer base, as the subsidy will be shared among all consumers of the National Interconnected System (SIN), affecting the calculation of indirect tax bases and sectoral charges.

Provisional Measure 1,300/2025 also establishes the timeline for universal access to the Free Energy Market, a process that begins in 2026 and will culminate in 2027 with the inclusion of residential consumers and small businesses. This change significantly impacts the active tax liability, calculation, and responsibility for collecting ICMS, IBS/CBS (post-tax reform), as well as redefining the incidence on usage tariffs (TUST/TUSD), requiring enhanced tax compliance for companies in the sector.

Another highly relevant point is the temporal limitation of discounts granted on transmission and distribution network usage tariffs (TUST/TUSD) for renewable sources, whereby only contracts signed by December 31, 2025, will retain the benefit for their initial term, with extensions or renewals prohibited from maintaining the same tax and tariff incentives. This restriction necessitates a detailed tax assessment of incentivized generation projects and may significantly influence the tax planning of companies operating in this segment.

Lastly, the Provisional Measure promotes adjustments in the allocation of sectoral charges, particularly the Energy Development Account (CDE), potentially altering the basis for passing on taxes and charges in the final consumer tariff, with a direct impact on the calculation of ICMS, PIS/COFINS, and, in the future, IBS/CBS.

Provisional Measure No. 1,300/2025 is in an advanced stage of processing in the National Congress, with a constitutional deadline until September 2025, and is expected to be converted into ordinary law within this year. Until its final conversion, aspects such as access criteria to the free market, implementation of the Supplier of Last Resort (SUI), and details of accounting separation will be regulated through infra-legal acts by ANEEL and the Ministry of Mines and Energy, with a scheduled phased implementation starting in 2026. The sector anticipates full universalization of the ACL by 2027-2028, accompanied by intensive regulatory and tax adaptations.

V. Law 15,103/2025 (PATEN) – Tax Incentives and Financial Instruments for the Energy Transition

Law No. 15,103/2025 establishes the Program for Accelerating the Energy Transition (PATEN), creating a modern framework of tax incentives and financial instruments to boost investments in modernizing the energy matrix, renewable energy generation, energy efficiency, and technological innovation.

Among the key tax innovations is the authorization for federal or state tax credits, including those subject to settlement or installment agreements, to be used as guarantees for obtaining financing for projects certified under PATEN. This provision represents a significant tool for tax regularization, enabling the offsetting of tax debts through investments in strategic energy sustainability projects, subject to stringent regulatory criteria, including compliance analysis and ANEEL certification.

Additionally, the law stipulates that funds not allocated to PATEN projects by the end of each fiscal year must be transferred to the Energy Development Account (CDE), impacting the sector’s economic-financial balance and indirectly contributing to tariff affordability, consequently promoting neutrality or reduction in the tax burden passed on to the final consumer.

Law 15,103/2025 serves a dual purpose: it facilitates structural investments and technological development in the electricity sector while innovating in sustainable tax compliance and settlement mechanisms, marking a new era of alignment between fiscal policy, energy transition goals, and tax justice.

Its effective operationalization still depends on federal regulation, particularly by the Ministry of Mines and Energy (MME) and BNDES, regarding the definition of project approval criteria, the operation of the Green Guarantee Fund, and the structure of ANEEL certification processes for eligible sustainable projects. As of September 2025, no large-scale private projects have been certified or directly financed through PATEN, but the government has announced the first calls for proposals for the last quarter of the year, prioritizing projects in infrastructure, biogas, hydrogen, waste management, and grid modernization.

VI. 2025 Tax Reform and Its Effects on Electricity Taxation

The recent Tax Reform, primarily consolidated by Complementary Law No. 214/2025, introduced significant structural changes to the taxation of the Brazilian electricity sector, with direct effects on the incidence and calculation base of taxes applicable to electricity.

- Complementary Law No. 214/2025 created new taxes: the Goods and Services Tax (IBS), under subnational jurisdiction, and the Social Contribution on Goods and Services (CBS), under federal jurisdiction, which replace PIS/COFINS and ICMS in the consumption chain.

- The implementation of the new taxes, IBS and CBS, will follow a transition schedule starting in 2026 and extending until 2033, as stipulated by Complementary Law No. 214/2025.

In 2026, a test phase will commence with nominal rates (IBS at 0.1% and CBS at 0.9%), aimed at adapting corporate systems and calibrating the operational framework of the new model.

From 2027, the CBS will be implemented at its full rate, replacing PIS/COFINS. The IBS will have a progressive rate: between 2029 and 2032, ICMS/ISS rates will be reduced annually (from 90% to 60% in four stages), while IBS rates will gradually increase until 2033, when ICMS, ISS, and state/municipal tax benefits will be fully extinguished, and the new system will be in full effect.

During the transition period, tax neutrality will be ensured, and accumulated credits from extinguished taxes may be offset or refunded, as provided in specific regulations. - As outlined above, the Tax Reform advocates the use of a single rate for all goods and services, which simplifies the system by replacing the varying ICMS rates applied in each state.

- In this new tax structure, the tax itself will not be included in its own calculation base (external incidence for IBS and CBS), ensuring non-cumulativity.

- One of the main principles of the Tax Reform, taxation at the destination for IBS and CBS, does not impact the sector, as the ICMS on electricity already follows this rule.

- Electricity has been equated to a material good with economic value for tax purposes, providing legal certainty and expanding the taxable base, including charges and taxes in the calculation base, which may lead to double taxation if parallel regulatory adjustments are not made.

- Taxation under IBS/CBS occurs at the time of payment, not necessarily at the physical delivery of electricity, requiring contractual and tax adjustments for companies in the sector.

- The responsibility for tax collection varies by contracting environment: in the Regulated Environment, distributors collect the taxes; in the Free Environment, the generator or trader is responsible when the sale is for consumption. In multilateral acquisitions, the buyer collects the taxes.

- The transmission of electricity is subject to taxation at the time of payment for the service provided.

- The legislation provides for tax relief for distributed generation, excluding compensated energy from the IBS/CBS calculation base, maintaining incentives similar to the current ones.

- The Reform also established that no Selective Tax will apply to electricity, dispelling previous concerns about additional taxation.

- Transparency of tax costs will be enhanced, with taxes clearly itemized on invoices, enabling better control and potentially reducing tariffs for the final consumer.

- The reform maintains features of the current regime, such as deferred taxation to final consumption, focusing on simplification and tax neutrality in the sector, but it requires companies to adapt their controls and contracts to the new rules.

These changes are part of the modernization of the Brazilian tax system and are expected to positively impact the electricity sector, provided they are accompanied by appropriate regulation from ANEEL and the government to avoid overlapping taxation and legal uncertainty.

Authors: Sabine Ingrid Schuttoff / Claudia Derenusson Riedel / Camila Santana

De Luca, Derenusson, Schuttoff & Advogados – DDSA

Rua James Joule, 92 – 6th floor – Brooklin

04576-080 – São Paulo – SP

Phone: +55 (11) 3040 4040