On August 20, the Legal Committee held a face-to-face seminar on:

“Current issues in Compliance: metrics, indicators for the effectiveness of the integrity program”

The Seminar proposes to reflect on the importance of monitoring the projects and programmes that make up the Compliance area and the challenges it faces. In particular, the conscious and effective use of the Whistleblowing channel, the development of metrics and KPIs, as well as the adjustments needed to meet and achieve standards of excellence and recognition, both at the national level, such as Pro-Ethics, and in international rankings and certifications..

Summaries and Speakers

Pro-Ethics – benefits and challenges

Comments on the corporate integrity award coordinated by CGU – Pró-Ética. The benefits of preparing for participation, as well as the main challenges encountered.

Heloisa Uelze

Partner at Trench Rossi Watanabe. With more than 30 years of experience, she currently heads the Public Law, Government Relations and Regulatory Group and the Investigations, Compliance and Ethics Group at Trench Rossi Watanabe. She works with clients to strengthen their compliance functions, improving both internal policies and the mechanisms by which they are applied. She has extensive experience coordinating large and complex multi-jurisdictional investigations. Heloisa has been recognized for her work by leading legal directories such as Chambers, LACCA Approved, Latin Lawyer 250, Leaders League, Análise Advocacia 500, Análise Advocacia Mulher, Thomson Reuters Stand-out Lawyers, Best Lawyers and Legal 500.

Felipe Noronha Ferenzini

Partner at Trench Rossi Watanabe Advogados. He has more than a decade of experience in compliance, regulatory and administrative law, assisting public and private clients in national and multi-jurisdictional operations and investigations. He also has extensive experience in the implementation of compliance, risk and governance programs (risk assessment, internal policies, remediation mechanisms, training). He has been recognized in the area of compliance by Chambers (Brazil and Global), Legal 500 (named Next Generation Partner), LACCA (Latin America Corporate Counsel Association), Leaders League, among others.

Silvia Bernardino

Partner at Trench Rossi Watanabe Advogados. She has solid experience in M&A transactions, carve-outs, corporate restructurings, joint ventures and corporate work. She is ranked among the elite in M&A by LACCA Approved (Latin Lawyers), Legal Analysis and Legal 500. She holds a law degree from the Pontifical Catholic University of São Paulo and an LLM from Cornell University. Silvia has worked extensively with Swiss companies.

Effectiveness of the Compliance Program: Metrics and Indicators

The Compliance Program must have defined metrics and indicators so that the company can assess its effectiveness, dissemination, application and points for improvement. The lecture aims to raise awareness of the importance of these issues and provide guidance on how to develop them, either in the design of the Program or in the improvement of existing Programs.

Livia Fabor de Queiroz

Livia is a senior manager in the Corporate Governance and Compliance Programs area of the São Paulo office of Gaia, Silva e Gaede. Recognized as one of the 500 most admired lawyers in Brazil by Análise Advocacia magazine in 2019, 2020, 2021 and 2022, she was also a consultant invited by the National Council of Justice (CNJ) on matters related to the General Data Protection Law. The lawyer was also listed in the “Compliance on Top 2023” yearbook and is the author of several articles on Compliance and Digital Law. In addition to her work as a lawyer, she has also been a Compliance Officer at a financial institution and a large public company.

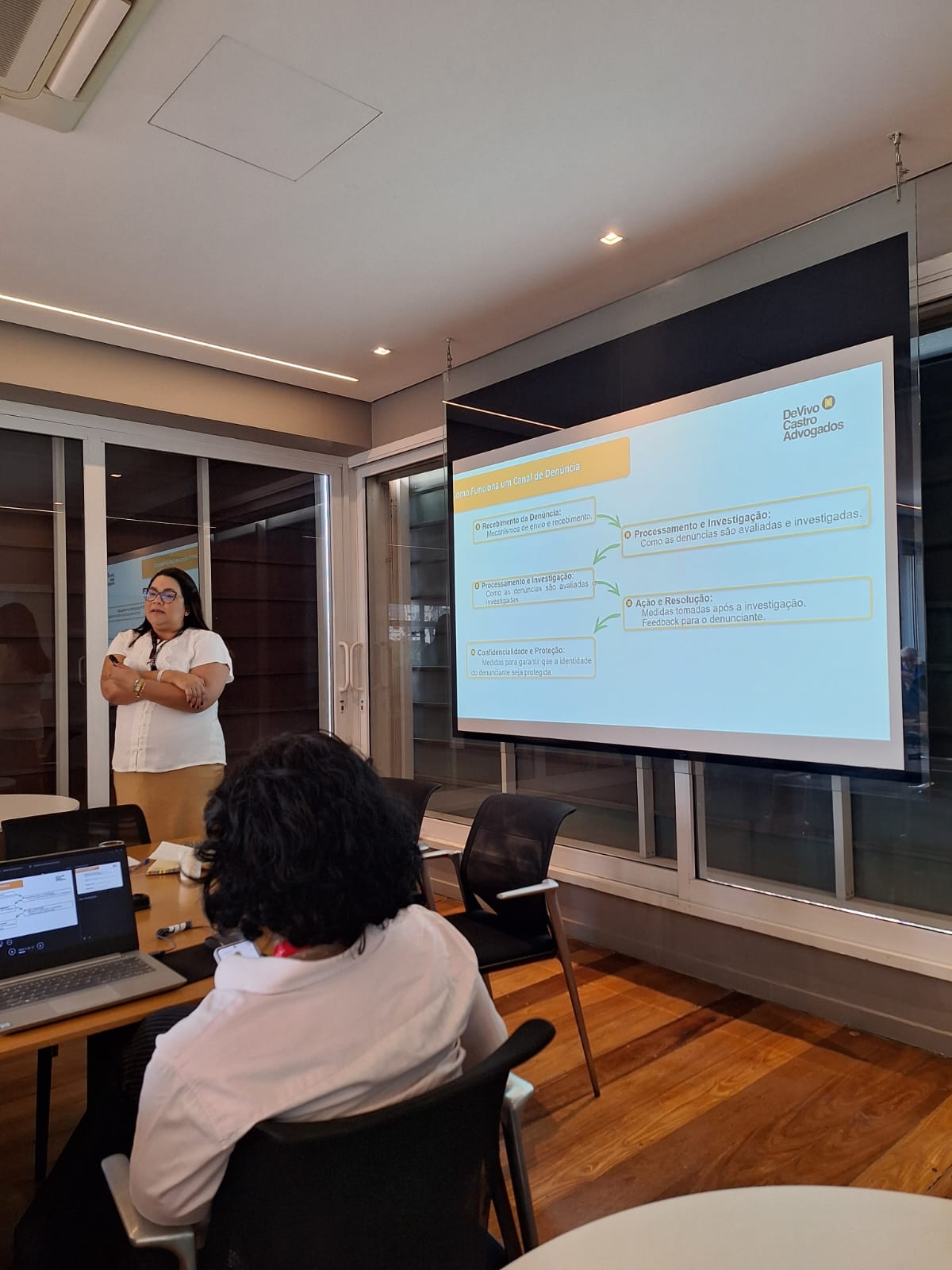

Reporting channels – proper and efficient use of the means of communication

We will approach the subject in a current way and based on cases, in order to discuss the effectiveness of using the means of communication and the possibility of extracting compliance metrics.

Renata Assalim

Head of the Contracts, Compliance and Intellectual Property practices at De Vivo, Castro, Cunha e Whitaker Advogados. MBA in Digital Technologies and Sustainable Innovation – Polytechnic School of the University of São Paulo – USP (2020). Certified Expert in Compliance – ARC Institute – Auditing, Risk Management and Compliance (2017). Lato Sensu Postgraduate Degree in Civil Law – Faculdades Metropolitanas Unidas – FMU (2006). Law degree – Padre Anchieta Law School in Jundiaí (2002). Member of the OAB/SP Special Compliance Committee.

.

Financial Fraud – Regulatory Aspects of Payment Arrangements and CVM Funds

Financial fraud is increasingly affecting the financial and capital markets, with growing numbers and sophistication. The notable relaxation of the rules governing the Brazilian payment system, carried out by the Central Bank of Brazil in recent years, both with regard to financial market infrastructures and so-called payment arrangements, has been a real regulatory breakthrough. However, the risks associated with these innovations seem to demand increased attention in terms of compliance. Also in the field of investment funds, the large number of frauds that plague these entities make it imperative to review and adapt their control, verification and monitoring procedures for the goods and rights that make up the assets of the portfolios invested in, as well as a careful verification of the liabilities of these funds.

.

Leandro Augusto Ramozzi Chiarottino

Founding partner of Chiarottino & Nicoletti Advogados. He has consolidated experience in corporate law, capital markets and foreign investments, including highly complex litigation. Throughout his career, he has acted in several relevant negotiations involving Brazilian and foreign companies and family successions.

Third parties in the value chain – new regulatory challenges on the ESG agenda

The ESG agenda is becoming increasingly important in the value chain as the national and international regulatory environment changes, e.g. the new EU CS3D legislation which aims to create transparency in the chain towards strict requirements for social and environmental standards and governance such as compliance and controls. These challenges mainly include challenges for direct and indirect third parties in the value chain, which can create regulatory (legal liability for the Board and company under CS3D), financial and reputational risks. In the presentation we will address challenges for the business world, but we will also discuss new opportunities and business models that may emerge ahead of the new ESG agenda for a more sustainable and green business world.

Lutz Kuehne

Head of Compliance & ESG at Rödl & Partner, with extensive experience in compliance, ESG, sustainability and new business model solutions. His work focuses on the industrial sectors of energy, agribusiness, logistics, automotive, pharmaceuticals and technology. He holds a Master’s degree in International Business from Friedrich-Alexander University in Nuremberg and an MBA in Financial Management, Auditing and Controllership from Fundação Getúlio Vargas.

Matias Dallacqua Illg

Head of Compliance & Investigations at Rödl & Partner, with extensive experience in corporate investigations, operational fraud, anti-corruption, corporate compliance and anti-corruption due diligence. His practice is focused on the industrial sectors of agribusiness, automotive, energy, family offices and the middle market. He holds a Master’s degree in Criminology from the Università Sapienza di Roma (Italy), an MBA in Agribusiness from USP/Esalq and a Bachelor’s degree in Law from PUC Campinas.